The Evergrande Stampede!

Good Morning!

The rout is spreading beyond borders, as the 500 richest people in the world lost a collective $135bn on Monday - with concerns, vis-a-vis the Evergrande fiasco, triggering a sell-off. Elon Musk lost $7.2bn, and the net worth of Jeff Bezos came down by $5.4bn.

And it isn’t getting any better. If the S&P Global rating report is to be believed, it is highly unlikely that Beijing will provide any direct support to the embattled developer Evergrande. The report says Beijing will only intervene if the contagion spreads and poses a systematic threat to the economy.

The buffer! Overseas investors are showing keen interest in the US bonds, which might help soften the blow when the Fed actually begins to taper the bond-buying program. In August, 25% of the 10 Year-US Treasury notes were bought by foreign investors, 16% in July.

Robinhood, Squared! In direct competition to two major stock trading platforms, Robinhood and Square, the $33bn fintech startupRevolut is set to offer commission-free stock trading in the US.

Buy Now Pay Later! This sector of e-commerce is already into the $100bn industry. In 2020, the BNPL accounted for 2.1% - or $97bn - of all global e-commerce transactions. Giants like Amazon, Apple, and Square are venturing into the industry and it can only get bigger from here.

India shining! The Indian Stock market might surpass the UK as the world’s fifth-largest stock market in just three years here on, as the country’s startups managed to raise $10bn in IPOs so far this year. In the next 36 months, 150 firms could potentially list on the stock market, adding as much as $400 in market value.

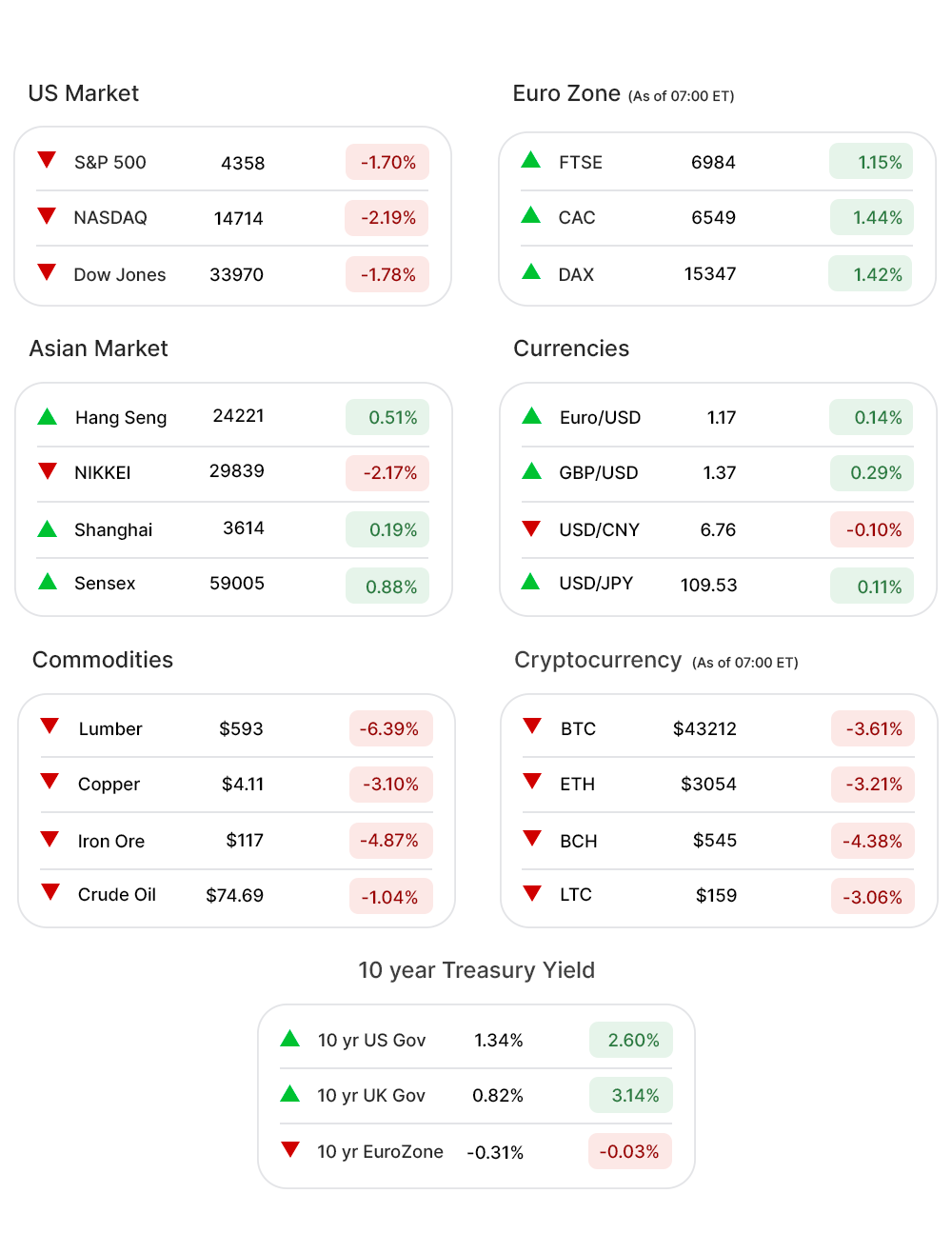

US Markets:

In sync with the global stocks, the US stocks began the week with a broad pullback with S&P 500 (-1.7%▼) recording its worst day since May 12. The broadest index presently sits 4.1% lower than its record high.

A day ahead of the FOMC meeting, other indices suffered heavy losses as well. Dow Jones (-1.8%▼) plummeted more than 610 points, its biggest one-day drop since July 19. Russel 2000 (-2.44%▼) shed a little less than 55 points.

Nasdaq (-2.2%▼) shed more than 320 points as growth stocks were some of the hardest hit.

It was a bloodbath in the sectors at the S&P 500, with not even a single sector in green.

Materials (-3.95%▼) and Energy (-3.04%▼) were the hardest hit sectors, followed by substantial losses in Consumer Discretionary (-2.37%▼), and Financials (-2.22%▼).

Sectors recording losses of more than 1% included Communication Services (-1.85%▼), Industrials (-1.01%▼), Technology (-1.86%▼), and Consumer Staples (-1.05%▼).

Healthcare (-0.98%▼), Utilities (-0.21%▼), and Real Estate (-0.63%▼) ended on the losing side as well.

Futures!

The Futures seem to be taking a cue from the EU markets and were advancing well, early Monday morning with all major indices in green.

As of 07:00 ET, Nasdaq Futures (0.75%▲) was up more than 100 points, Dow Futures (0.93%▲) was advancing with a 300 point gain, S&P 500 Futures (0.85%▲) had gained more than 36 points already, and Russel 2000 Futures (1.2%▲) was moving ahead with a gain of over 25 points.

Key Movers in Small Cap:

Surface Oncology Inc (SURF, 3.24%▲) slipstreamed behind Astra Zeneca, as the latter shared positive news about its new Cancer Drug. The relative volume of the stock was 13.5.

Protagonist Therapeutics Inc (PTGX, -26.13%▼) continued its downslide, a day after the FDA decided to shut all clinical trials of the company pertaining to Rusfertide. The relative volume of the stock was 8.5.

The other movers in the small-cap segment included:

Premier Financial Bancorp Inc (PFBI, -0.34%▼): Relative Volume 7.8.

Encore Wire Corporation (WIRE, -0.34%▼): Relative Volume 3.8.

BeyondSpring Inc (BYSI, -32.96%▼): Relative Volume 3.4.

Eagle Bulk Shipping Inc (EGLE, -13.58%▼): Relative Volume 3.1.

Nature’s Sunshine Products Inc (NATR, -0.55%▼): Relative Volume 3.0.

Key Movers in Large Cap:

Mirati Therapeutics (MRTX, 1.95%▲) Monday announced positive clinical data with investigation Adagrasib, as monotherapy in patients with mutated colorectal cancer. The relative volume of the stock was 5.3.

Brooks Automation Inc (BRKS, 8.83%▲) has announced plans to sell its chip-solutions unit for $3bn and said that it will no longer pursue splitting into two companies. The relative volume of the stock was 5.1.

The other movers in the large-cap segment included:

Tripadvisor Inc (TRIP, -7.60%▼): Relative Volume 3.9.

Caterpillar Inc (CAT, -4.50%▼): Relative Volume 2.5.

Acceleron Pharma Inc (XLRN, 1.42%▲): Relative Volume 2.5.

DoubleVerify Holdings Inc (DV, -7.11%▼): Relative Volume 2.5.

Cleveland-Cliffs Inc. (CLF, -9.65%▼): Relative Volume 2.4.

Report Card:

The title insurance company, Lennar Corporation (LEN, -2.94%▼), came out with net earnings of$1.4bn or, $4.52 per diluted share up more than 100% y-o-y, compared to diluted EPS of $2.12 or net earnings of $666.4m. The revenue of $6.9bn was up 18% y-o-y. The stock fell by more than 3% after hours.

On the Lookout:

The two-day FOMC meeting will begin today, and the statement by the Fed is due tomorrow.

Building Permits (SAAR), for the month of August, are expected to drop a little from July’s 1.63m to 1.62m now.

The Housing Starts (SAAR) on the other hand is expected to increase from July’s 1.53m to 1.55m in August.

Software maker, Clearwater Analytics Holdings, is eyeing a $4bn valuation as it proceeds to offer 30m shares of its common stock, priced between $14 and $16.

Covid test-maker, Cue Health, is looking to raise more than $100m by offering 12.5m shares of its common stock, priced between $15 and $17 per share.

The payments solutions provider, EngageSmart, is looking to raise $349m by selling 14.5m shares of its common stock, priced between $23 and $25 per share.

Unusually high shorter-term CALL options activity seen on Alphabet Inc (GOOGL, -1.48%▼), Editas Medicene Inc (EDIT, -7.91%▼), Bank of America (BAC, -3.29%▼), IVERIC Bio Inc (ISEE, -2.41%▼), and the Appharvest Inc (APPH, -4.61%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Tilary Inc Inc (TLRY, -7.72%▼), Starbucks Corporation (SBUX, -1.40%▼), Cinemark Holdings Inc (CNK, -2.39%▼), HSBC Holdings Plc (HSBC, -4.43%▼), and Tronox Holdings Plc (TROX, -4.61%▼) among others.

Other Asset Classes:

Crude Oil Prices - After falling more than 2% on Monday, the prices bounced back amid signals of theUS supply tightening. Brent crude gained more than 1% Tuesday morning and was trading well above the $74 per barrel mark, while WTI crude traded 1.20% higher.

The US Dollar (93.15, -0.14%▼) shed some gains after reaching a three-week high Monday morning.The future course of the greenback will be decided by the tone of the Fed following the two-day FOMC meeting.

The US Treasury Yields fell Monday along with the equities but made some marginal gains early Tuesday morning ahead of the Fed meeting. The 10 Year US Treasury Yield was trading at 1.328%, in the green zone, though considerably lower than Monday’s 1.341%.

Global Markets:

Asian Markets: The stocks in the Asia Pacific fought for footing on Tuesday as the Evergrande fiasco looms large on the minds of the investors. The results were mixed. Hang Seng, managed to hover right below the zero-mark,0.18% lower, even as Shanghai clawed 0.19% higher. Tokyo’s Nikkei shed some 660 points and was more than 2% into the negative territory.

Despite the mounting concerns over the Evergrande crisis, the European markets Tuesday managed a turnaround, with all major indices making substantial gains, soon after the markets opened. FTSE gained 0.76%, CAC was up 0.94%, DAX climbed 0.64%, and the pan-EU index Stoxx-600 managed to claw up by 0.61%, early Tuesday morning.

Meanwhile on Researchfin.ai

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.comin your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.