The Flight of Negative-Yield!

Good Morning,

The global stock of negative-yielding debt has swelled to $16.5tr, highest in six months, as a relentless rally has continued in the bond markets and has dragged the borrowing rate below zero.

The Fed Vice Chair, Richard Clarida, has said that the central bank will hit economic targets by the end of next year and start raising rates again in 2023. He did not give a timetable for tapering of monthly asset purchases, of $120bn a month, however.

BoE will wait though! The Bank of England has kept its monetary policy unchanged in it’s Thursday’s MPC meet, but has warned of a more pronounced period of above-target inflation in the near term.

EVs are the future, there is no denying that. President Biden is set to call for a new national target for the adoption of Electric Vehicles, calling for them to represent 40% to 50% of all new car sales by 2030. Executives from General Motors, Ford Motor, and Stellantis will meet Biden at the White House today.

Robinhood continues to gallop! The stock closed 50.4% up on Wednesday, bringing its weekly gain to more than 100%.

US Markets:

Stocks fell Wednesday as pandemic woes vis-a-vis the economic recovery, and Fed announcing a timeline on a hike in interest rates outweighed the heartening earnings reports and positive signals from the Asian and European markets.

Besides, the ADP payrolls fell to 330,000 from June’s 680,000. Leisure and Hospitality added 139,000 payrolls.

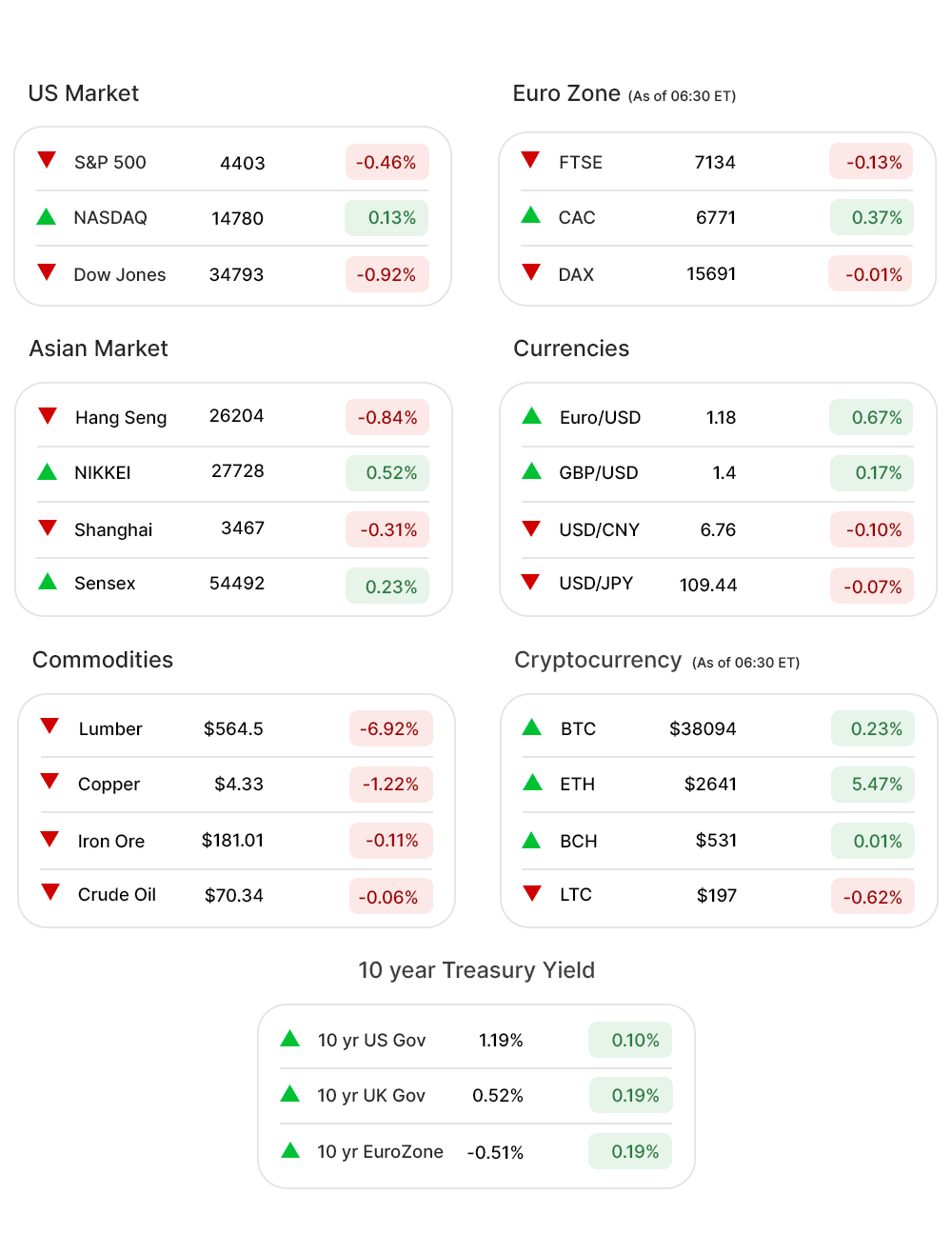

S&P 500 (-0.46%▼), after attaining a record high Tuesday, slid more than 20 points to close at 4403 Wednesday. Dow Jones (-0.92%▼) fell 320 points, while tech-heavy Nasdaq (0.13%▲) held some nerve and closed in green.

Sectors at the S&P 500 were all red, with the exception of Communication Services (0.23%▲) and Technology (0.19%▲).

Energy (-2.94%▼) was at the rock bottom of the sectors. Financials (-0.76%▼), Healthcare (-0.42%▼), Industrials (-1.37%▼) Consumer Staples (-1.26%▼), and Materials (-0.99%▼) followed the Energy sector into the red zone.

Futures!

The Futures looked quite steady and ahead of the zero levels as the morning progressed Thursday.

As of 06:00 ET: Nasdaq Futures (0.20%▲), S&P 500 Futures (0.26%▲), Russell 2000 Futures (0.31%▲), and Dow Futures (0.22%▲).

Key Movers in Small Cap:

Beyondspring Inc (BYSI, 176.01%▲) announced positive topline results in the DUBLIN-3 trial in Plinabulin for the treatment of 2nd/3rd line Non-Small Cell Lung Cancer. The relative volume of the stock was 474.9.

A law firm has announced that it was carrying out an investigation against Zymergen Inc (ZY, -76.31%▼), in a potential securities fraud at the company, on behalf of the purchasers of Zymergen. The relative volume of the stock was 43.2.

Option Care Health Inc (OPCH, -4.46%▼) has announced a secondary offering of 18m shares of its common stock, for a price of $20.25 per share. The stock fell from $21.16 to $20.34 on Wednesday. The relative volume of the stock was 10.9.

Real estate company eXp World Holdings (EXPI, 35.95%▲) posted an EPS of $0.24 on sales of $1bn, for Q2, crushing the estimates of $0.09 on sales of $728.8m. The relative volume of the stock was 10.3.

Atomera Inc (ATOM, 23.35%▲) reported no sales at all for Q2 with a loss of $0.17 per share. The stock soared after the CEO, Scott Bibaud, explained how the company’s computer modeling tools allowed a key customer to improve the performance of an upcoming product. The relative volume of the stock was 9.9.

The other movers in the small-cap segment included:

Unitil Corporation. (UTL, -7.10%▼): Relative Volume 9.5.

Avidity Biosciences (RNA, 3.26%▲): Relative Volume 8.9.

Cardlytics Inc (CDLX, -28.61%▼): Relative Volume 8.8.

Cerus Corporation (CERS, 20.66%▲): Relative Volume 8.7.

Coursera Inc (COUR, 21.38%▲): Relative Volume 8.1.

Key Movers in Large Cap:

A maker of electronics sub-systems, Mercury Systems Inc (MRCY, -12.05%▼) reported Q4 earnings of $0.73 per share on revenue of $250.8m, beating expectations. The outlook for the current quarter and the year however was disappointing. The relative volume of the stock was 16.4.

Weingarten Realty Investors (WRI, -2.06%▼) Wednesday announced the completion of the previously announced merger with Kimco Realty Corp. The relative volume of the stock was 8.5.

Casino owner VICI Properties Inc (VICI, -0.26%▼) has bought MGM Growth Properties for $17.2bn. Upon closure of the deal, VICI will have a market cap of $45bn and will likely be the biggest landowner in the Las Vegas strip. The relative volume of the stock was 7.7.

United Therapeutics (UTHR, 14.08%▲) reported a 23% y-o-y increase in its revenue, for Q2, to $446.5m. Net income also advanced 19% y-o-y to $193.5. The relative volume of the stock was 7.1.

The other movers in the large-cap segment included:

Change Healthcare Inc. (CHNG, -4.87%▼): Relative Volume 6.6.

Alteryx Inc. (AYX, -13.05%▼): Relative Volume 6.3.

NCR Corporation (NCR, -8.94%▼): Relative Volume 5.8.

Virtu Financial (VIRT, -5.23%▼): Relative Volume 5.6.

Report Card:

The drug wholesale company, AmerisourceBergen Corp (ABC, 1.94%▲) reported an adjusted EPS of $2.16, beating the estimated $2.01 and more than last year’s $1.85 for Q3. The revenue of $53.41bn was 3.6% more than the estimates. The stock was flat after hours.

The carmaker, General Motors (GM, -8.91%▼) managed to beat the expected revenue of $30.9bn by more than $4bn but fell short on the bottom line and reported an adjusted EPS of $1.97 versus the estimated $2.23. The stock climbed a little after hours.

Honda Motor Company (HMC, 0.88%▲) had reported a Q1 net income of $2.03bn, after reporting a loss in the same quarter the prior year. The EPS of the company was $1.18 and revenue stood at $32.74. The stock fell by more than 2% after hours.

Toyota Motor Corp (TM, -2.03%▼) comprehensively beat the estimates as it reported an EPS of $5.86 on revenue of $72.43bn, ahead of the estimated $4.49 on revenue of $67.73bn. The stock was flat after hours.

On the Lookout:

The Initial Jobless Claims, due today, is expected to fall from 400,000 previously to 385,000. Data on Continuing Jobless Claims as well as Trade Balance is due today, as well.

Unusually high shorter-term CALL options activity seen on HP Inc (HP, -1.56%▼), International Game Technology (IGT, -5.33%▼), Advanced Micro Devices (AMD, 5.52%▲), AMC Entertainment (AMC, -11.19%▼), and Coupang Inc (CPNG, 3.52%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Carnival Corp. (CCL, -1.82%▼), 8x8 Inc. (EGHT, -3.99%▼), Play Group. (PLBY,-8.05%▼), Beyond Meat Inc. (BYND, 0.20%▲), and Kellogg Company (K, -2.50%▼) among others.

Other Asset Classes:

Crude Oil prices continue to slide as more countries announce restrictions to contain the spread of the delta variant. Brent has fallen to the $70 per barrel mark, early Thursday morning while the WTI Crude was trading a little ahead of the $68 per barrel mark.

The US Dollar (92.22,-0.05%▼) is strengthening as the Fed Vice Chair, Richard Clarida, announced a timetable for tapering of the monetary stimulus.

US Treasury Yields remained little changed this morning as the dollar strengthened and all eyes remained on the jobs data. The 10 Year US Treasury Yield was in the green territory this morning at 1.194% while the 30 Year Treasury Yield advanced to 1.845%.

Global Markets

Asian Markets mostly fell after stocks ended considerably lower in the US Wednesday. Concerns surrounding the rise of the delta variant, the China outbreak and the subsequent travel restrictions in particular, also weighed heavily on the sentiment. Hang Seng lost 220 points to end 0.84% lower while Shanghai closed 0.31% into the red zone. Nikkei, though, gained 144 points for the day.

European Markets however advanced as investors looked beyond the delta virus threat and weighed in on better than expected earnings by some major companies of the zone, including Rolls Royce and Siemens.Pan European index Stoxx-600 was up 0.31% early morning. FTSE was however weighed down as investors braced for the Bank of England’s (BoE) monetary policy decision due today.

Meanwhile on Researchfin.ai

Getting better every day! Many more trade setups identified by our AI reached their respective profit targets yesterday, within their optimal holding period: Workiva Inc (WK), Chipotle Mexican Grill (CMG), Exponent Inc (EXPO), MaxLinear Inc. (MXL), PayCom Software (PAYC), Sprout Social Inc. (SPT), Illumina Inc (ILMN), Alkermes Plc (ALKS), Silicon Laboratories Inc. (SLAB), Maravai Life Sciences (MRVI), Jones Lang LaSalle Inc (JLL), Advanced Micro Devices (AMD), Power Integrations Inc (POWI), and GreenSky LLC (GSKY).

There are many more new trade setups identified by the AI yesterday. Please download our app Researchfin.ai for iOS and Android.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Happy trading!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.