The GAFA/Topix Crossover!

Good Morning!

The $7tn combined market cap of Alphabet (Google), Apple, Facebook, and Amazon (GAFA) is now worth more than Japan’s $6.8tn Topix. 41 percent of Topix stocks are still trading below pre-covid levels compared to 17 percent stocks in S&P500.

WhatsApp imposed a $266mn penalty for failing to be transparent with handling personal information, the first time under the beefed-up EU data protection law. The 3-year GDPR law allows authorities to fine as much as 4% of their annual sales.

Germany’s 32-year-old Dax index undergoes makeover as it expands from 30 to 40 of the biggest public companies and new profitability requirements.

South Korea’s headline inflation is at 2.6%, the highest since 2012. The central bank is one of the first to hike rates.

The ISM Manufacturing Index unexpectedly rose in August, remains elevated at 59.9.

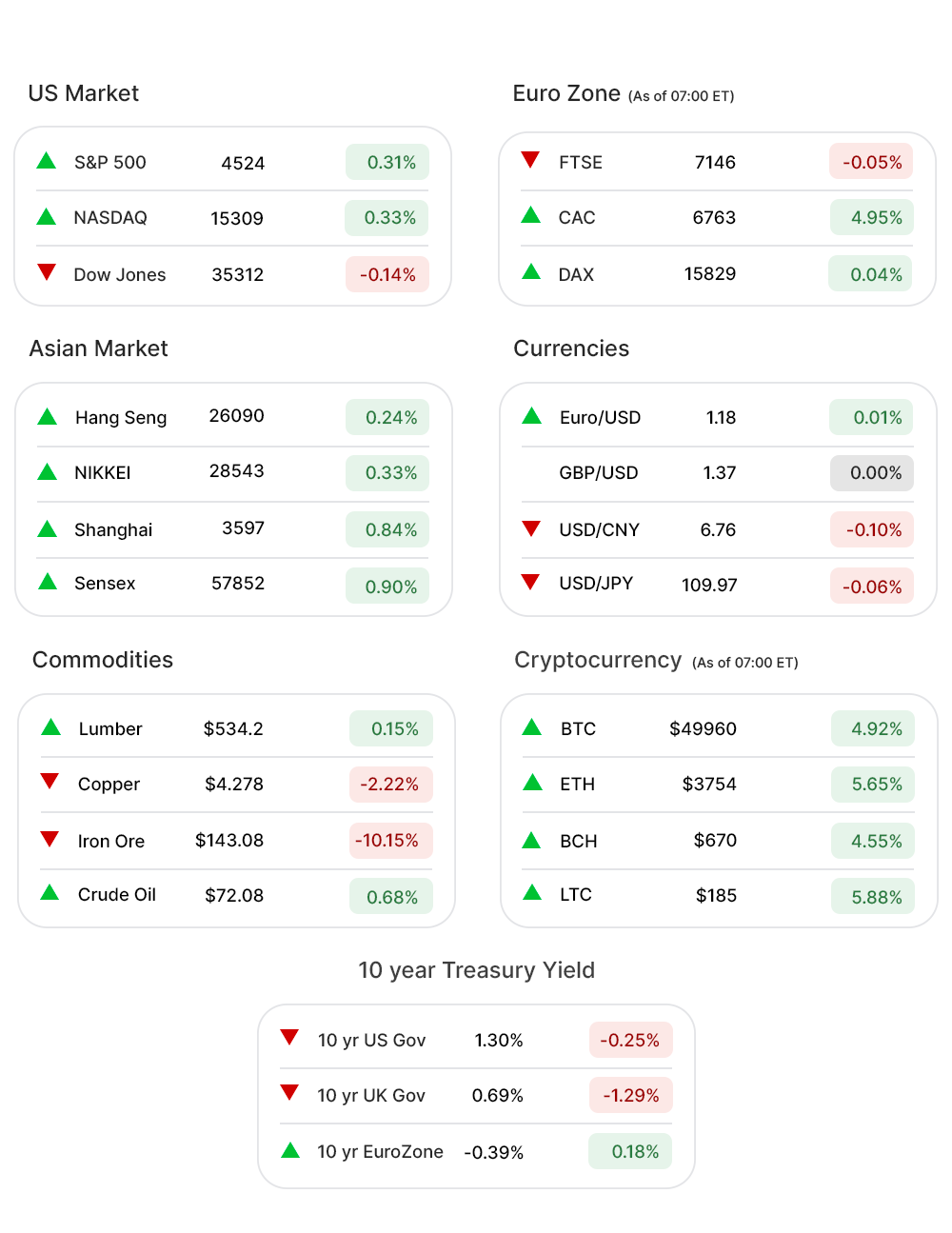

US Markets:

The Nasdaq Composite (0.3%▲) eked out fresh record highs on the first day of September, as new money continued to flow into the market's largest stocks amid softer economic data. The S&P 500 (0.03%▲) closed little changed after coming within one point of its all-time high with a 0.3% gain in the afternoon.

To its credit, the small-cap Russell 2000 (0.6%▲) outperformed the Nasdaq, while the Dow Jones Industrial Average declined 0.1%.

The S&P 500Real estate (1.7%▲) and Utilities (1.3%▲) sectors advanced more than 1.0% while Consumer Staples (0.54%▲), Communication Services (0.27%▲) , Technology (-0.56%▼), and Healthcare (-0.13%▼) were other gainers.

The cyclical Energy (-1.5%▼), Financials (-0.6%▼), Industrials (-0.4%▼), and Materials (-0.3%▼) sectors underperformed in negative territory. The latest data on the manufacturing sector and labor market were cited for the performance gap.

Futures!

Futures looked set for a positive opening!

As of 07:00 ET, all the indices were green, without an exception: Dow Futures (0.17%▲), Nasdaq Futures (0.22%▲), and S&P 500 Futures (0.18%▲).

Key Movers in Small Cap:

Ambarella Inc (AMBA, 27.41%▲), up by 58% from the previous year has predicted that revenue could hit a five-year high this quarter. The Relative Volume of the stock was 19.2.

Vera Bradley (VRA, -9.42%▼) reported Q2 revenue of $147 million with year-to-date earnings well ahead of last year and even ahead of the pre-pandemic season of fiscal 2020. The Relative Volume of the stock was 10.7.

Avidity Biosciences (RNA, 19.09%▼), has dropped almost twentieth of its value so far after the company announced the resignation of its chief medical officer Jae B. Kim effective August 30. The Relative Volume of the stock was 6.2.

The other movers in the small-cap segment included:

Aligos Therapeutics Inc (ALGS, 2.70%▼): Relative Volume 5.4..

Greenwich Lifesciences (GLSI, 9.32%▲): Relative Volume 5.2.

Revolve Group Inc (RVLV, 7.83%▲): Relative Volume 5.4.

Key Movers in Large Cap:

AbbVie Inc (ABBV, -7.05%▼) fell off Wednesday following FDA’s decision to require a heart-risk warning on the label of its arthritis treatment Rinvoq, Abbvie’s hope after the expiry of Humira’s patent. The relative volume of the stock was 10.2.

Anaplan Inc (PLAN, 10.30▼) shares traded sharply as analysts’ cheer its Q2 strong earnings and guidance by raising price targets. The relative volume of the stock was 5.4.

Wells Fargo & Co. (WFC,4.92▼) Day 3 of the steep fall on the heels of news for more fines and penalties linked to the account opening scandal. The relative volume of the stock was 3.5.

The other movers in the large-cap segment included:

DXC Technology (DXC, -5.07%▼): Relative Volume 4.5.

Skillz Inc (SKLZ, 3.74%▲): Relative Volume 4.6.

C3.ai Inc (AI, 3.05%▲): Relative Volume 4.6.

On the Lookout:

Investors will receive the weekly Initial and Continuing Claims report, the Trade Balance for July, Factory Orders for July, and the revised Productivity and Unit Labor Costs for the second quarter on Thursday.

Unusually high shorter-term CALL options activity seen on Affirm Holdings Inc (AFRM, 0.15%▲), Wisekey International Holding (WKEY, 6.28%▼), Skillz Inc (SKLZ, 3.74%▲), McDonald's Corp (MCD, 0.29%▲), and Lucid Group (LCID, 10.87%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Taiwan Semiconductor Mfg. (TSM, 1.22%▲), Apple Inc. (AAPL, 0.45%▲), Teradyne (TER, 1.46%▼), Palantir Technologies (PLTR, 0.53%▼), and AMC Entertainment Holdings (AMC, 7.30%▼) among others.

Other Asset Classes:

The Treasury market remained subdued in a wait-and-see trade for the August Employment Situation Report on Friday, which is the report on the labor market that carries the most weight for the Fed and the broader market.

The 10-yr yield was unchanged at 1.30%, and the 2-yr yield increased one basis point to 0.21%. The U.S. Dollar Index decreased 0.1% to 92.52. WTI crude futures increased 0.2%, or $0.11, to $68.55/bbl amid an expected OPEC+ decision to keep production-increases steady at 400,000 bpd.

Global Markets:

Hong Kong’s Hang Seng and mainland China’s CSI 300 indices both inched higher in early trading on Thursday. Japan’s Topix and South Korea’s Kospi fell slightly. The S&P/ASX 200, which tracks Australian stocks, was also down. The gains in China came as the prospect of renewed government stimulus helped tech companies shake off the effects of the regulatory clampdown.

European stocks traded cautiously on Thursday as investors awaited US jobs data. The Stoxx Europe 600 added 0.2 percent by mid-morning while the UK’s FTSE 100 was flat.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Vocera Communications (VCRA), Dynatrace Inc (DT), Sun Communities (SUI), Aon PLC (AON), Sea Ltd. (SE), LendingClub Corp (LC), Thomson Reuters Corp (TRI), Elastic NV (ESTC), Charles River Laboratories Intl. (CRL), Carter Bank and Trust (CARE), and Sea Ltd(SE). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.