The Slowing Giant!

Good Morning!

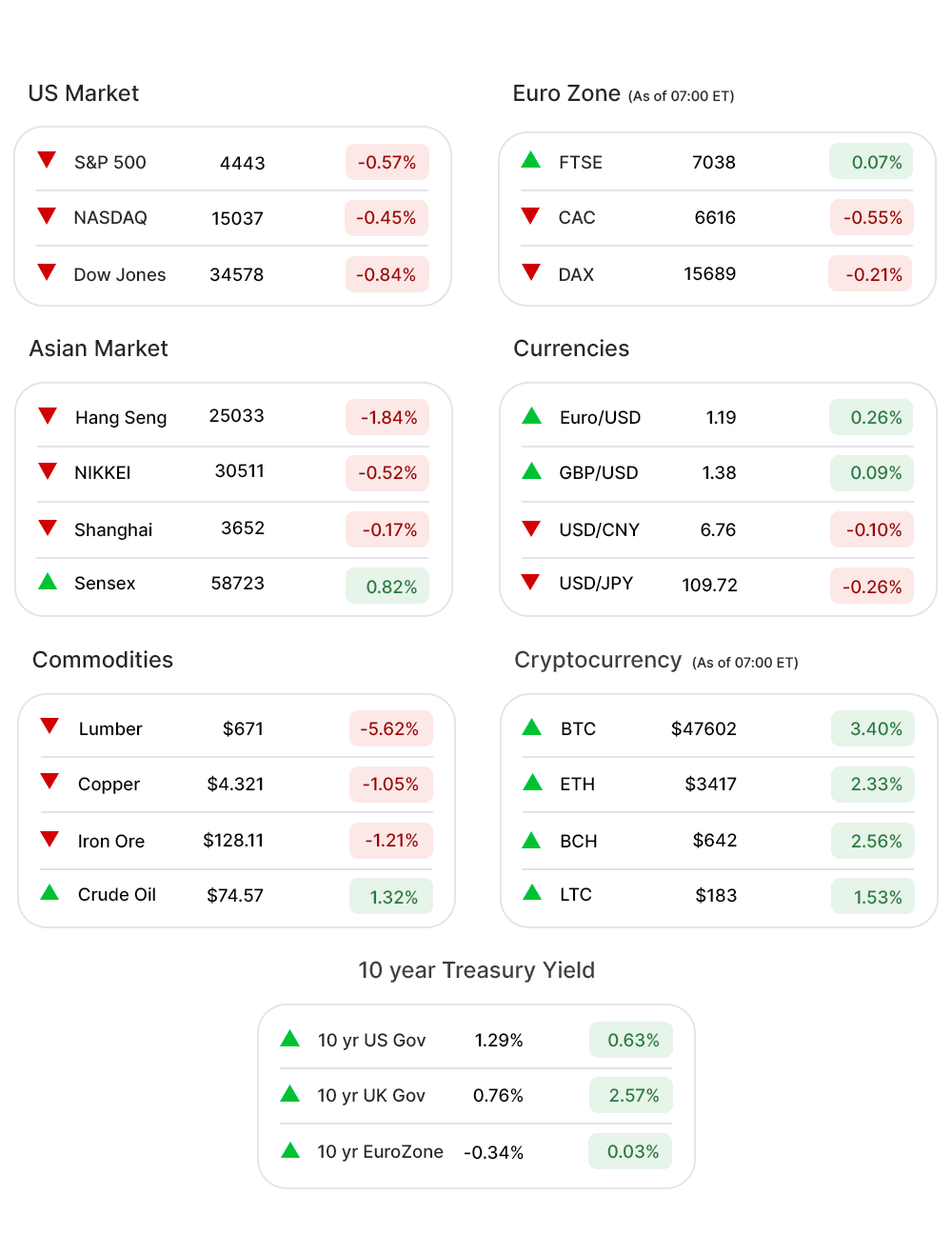

The slowdown! China’s Retail Sales have grown by a disappointing 2.5% in August, from a year ago, far slower than the expected 7%, as the country recently battled with worst outbreak of Covid-19, since the beginning of the pandemic. Industrial Production was up 5.3%, a little slower than the expected 5.8%. Asian markets pulled back.

The Casino wipeout! $18.4bn were wiped out off the market-worth of listed playing operators, following Macau government’s drive to extend oversight of casinos. Sands China tumbled 32.5%, Wynn Macau fell 29%, and MGM China shed around 27%.

Hey! Do you own Microsoft shares? The company has increased its yearly dividend by11%, from 56 cents to 62 cents - the 12th straight yearly increase in dividends by the tech giant. They have also unveiled a $60bn stock buyback program.

And what a time for the dividends! Apple has just launched a range of new products, including the iPhone 13. Just saying, in case you are a “club Apple” member.

The inflation might be cooling off, finally! The US Consumer Price Index for August increased by 5.3%from a year earlier, and 0.3% from July, both figures lower than the expected 5.4% and 0.4%. The Core CPI gained 0.1%, up 4% y-o-y.

Not in the UK, though, where the inflation rate today posted biggest increase since records began in 1997! The CPI came out at 3.2%, for August, way ahead of a predicted reading of 2.9%. FTSE climbed, regardless, as other major indices in EU slid.

NFIB Small Business Optimism Index has breached the 100 level, with a print of 100.1, up 0.4 points from July’s reading. 50% of businesses, however, still have vacancies they cannot fill. The NFIB Uncertainty Index has decreased 7 points to 69, the lowest since January 2016.

US Markets:

The initial buoyancy in the stocks quickly faded following Fed’s Inflation report, increasing the likelihood of a corporate tax rate hike, and dampening the investor sentiment.

S&P 500 (-0.57%▼) finished below its closing level for the sixth day in a row, something that last happened in February 2020. Dow Jones (-0.84%▼) slid close to 300 points, while Russel 2000 (-1.37%▼) shed over 30 points.

Tech-heavy Nasdaq (-0.33%▼) continued the losing streak, sliding down more than 50 points by the end of the trading day Tuesday.

None of the sectors at the S&P 500 could register any gains, despite the initial positivity in the stocks.

Energy (-1.55%▼), after being the highest gainer Monday, was the worst-hit sector on Tuesday, followed by substantial losses in Financials (-1.41%▼), Industrials (-1.23%▼), Materials (-1.17%▼), and Communication Services (-0.88%▼).

Consumer Discretionary (-0.33%▼), Consumer Staples (-0.60%▼), Technology (-0.14%▼), Real Estate (-0.34%▼), Healthcare (-0.12%▼), and Utilities (-0.18%▼) also fell below the zero levels.

Futures!

The US stock futures looked upbeat, early Wednesday morning.

As of 07:00 ET, all the major indices were in the green zone. Nasdaq Futures (0.19%▲), Dow Futures (0.02%▲), S&P 500 Futures (0.11%▲), and Russel 2000 Futures (0.09%▲).

Key Movers in Small Cap:

PAR Technology Corporation (PAR, -18.07%▼) intends to sell 1.5m shares of its common stock, and issue debt to finance further growth initiatives. The Relative Volume of the stock was 21.1.

FuelCell Energy Inc (FCEL, 14.59%▲) announced its Q3 financial results, beating the estimates quite comprehensively. The Relative Volume of the stock was 13.6.

BRP Group Inc (BRP, -16.92%▼) is offering 8m shares of its common stock, priced at $30.5 per share. After Tuesday’s loss, the BRP stock is worth $31.27. The Relative Volume of the stock was 6.9.

Crocs Inc (CROX, 8.47%▲) touched an all-time high Tuesday after the shoe-maker introduced a new shoe made of bio-based material, another step towards delivering on its pledge of net zero emissions by 2030. The Relative Volume of the stock was 5.9.

The other movers in the small-cap segment included:

Marlin Business Services (MRLN, -0.22%▼): Relative Volume 10.2.

Mid Penn Bancorp Inc (MPB, 0.08%▲): Relative Volume 5.8.

Akoya Biosciences Inc (AKYA, -1.57%▼): Relative Volume 5.6.

NeuroPace Inc (NPCE, -5.48%▼): Relative Volume 5.5.

NeoGames S.A. (NGMS, 2.77%▲): Relative Volume 5.4.

Key Movers in Large Cap:

Herbalife Nutrition Ltd (HLF, -21.13%▼) Monday announced that lower than expected levels of activity among its distributors, has led to a decrease in expected Q3 and full-year net sales. The relative volume of the stock was 11.8.

Casino operator stocks, including Wynn Resorts Limited (WYNN, -10.85%▼), with major exposure to Macau, as China eyes tougher regulations. The relative volume of the stock was 8.8.

Las Vegas Sands (LVS, -9.75%▼), with a relative volume of 7.6, was another casino operator stock to fall Tuesday.

Jamf Holding Corporation (JAMF, -6.71%▼) has announced plans to raise capital by selling convertible notes, spooking the investors. The relative volume of the stock was 5.3.

The other movers in the large-cap segment included:

Comcast Corporation (CMCSA, -7.30%▼): Relative Volume 3.8.

Acadia Healthcare Company (ACHC, -6.98%▼): Relative Volume 3.5.

Life Storage Inc (LSI, -2.87%▼): Relative Volume 3.2.

Pinnacle West Capital (PNW, -1.46%▼): Relative Volume 2.9.

OPendoor Technologies Inc (OPEN, -4.84%▼): Relative Volume 2.8.

Report Card:

FuelCell Energy Inc (FCEL, 14.59%▲) reported a 43% increase in revenue y-o-y to $26.8m, even as the gross profit jumped 135% y-o-y to $1.1m. The company’s backlog is down 2% to $1.3bn. The stock remained in green zone after hours.

A specialized distributor of water, wastewater, storm drainage, and fire protection products, Core & Main Inc (CNM, 0.93%▲) reported a 36% y-o-y increase in sales to $1.3bn. The net income of $9.5m was way lower than the $18.1m, a year earlier. The stock remained flat after hours.

On the Lookout:

The Import Price Index is expected to remain unchanged at 0.3%, when the data is released later in the day.

The Empire State Index, for the month of September, is expected to slide from 18.3 to 17.2.

Industrial Production, for the month of August, is expected to slump from July’s 0.9% to 0.5%.

Some IPOs to look out for:

EzFill Holdings is offering 6.2m shares of its common stock, priced at $4 per share. The stock is expected to start trading on September 16.

Another company to have debuted in the stock market tomorrow is ForgeRock Inc, with an offering of 11m shares of its common stock, priced between $21 and $24 per share.

Unusually high shorter-term CALL options activity seen on Royal Carribean Cruises (RCL, -1.69%▼), Snap Inc (SNAP, 0.07%▲), Roblox Corp (RBLX, -2.74%▼), Las Vegas Sands (LVS, -9.75%▼), and Wells Fargo & Co (WFC, 0.63%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Comcast Corporation (CMCSA, -7.30%▼), Luminar Technologies Inc (LAZR, 1.58%▲), Walmart Inc (WMT, -0.52%▼), WELL Health Technologies (WELL, -1.05%▼), and Silicon Motion Technology Corp (SIMO,-0.38%▼) among others.

Other Asset Classes:

Crude Oil Prices - The prices climbed again, Wednesday morning, a day after a larger than expected drawdown in Crude Oil stocks in the US, world’s largest oil consumer. Brent was up 0.80% Wednesday morning, while WTI Crude was into the green zone by 0.91%.

The US Dollar (92.47, -0.16%▼) continued to tumble after better than expected inflation data was released by the Fed Tuesday, indicating that the inflation might be temporary after all.

The US Treasury Yields after falling on Tuesday were mixed Wednesday morning - following the better than expected inflation data - with the 10 Year US Treasury Yield trading into the green zone at 1.28%, and the 30 Year Yield trading at 1.84%, down one basis point.

Global Markets:

The Asian Markets were mostly in the negative zone, following weak economic data from China fanning worries over global economic recovery. The rout in US markets on Tuesday added to the subdued investor sentiment. Hang Seng, fell by about 470 points or 1.84% along with Shanghai, losing 0.17%. Tokyo’s Nikkei rfell by about 160 points or 0.52%.

The negativity was rubbed on to the European markets, as most of the major indices opened in the negative territory. Wednesday morning, CAC had slid by 0.20%, while DAX was flat in the negative zone. Pan-EU index Stoxx-600 was also trading lower by 0.12%. FTSE, was the only green index, trading up by 0.04%.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Lattice Semiconductor Corp (LSCC), California Resources Corp (CRC), Regenxbio Inc (RGNX), Comstock Resources Inc (CRK) and Allakos Inc. (ALLK). Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Same time, tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.