The Taper Conundrum!

Good Morning!

The billion-dollar question! The Fed looks all the more divided on whether to taper stimulus or not as President of the St. Louis Fed, James Bullard rejects concerns that labor market recovery is faltering despite only 235,000 jobs being created in August. He reiterated his call for the downsizing of the bond-buying program.

The Chinese approval! BlackRock Inc. has raised around $1bn for the first-ever mutual fund, solely run by a foreign firm that is allowed to sell to Chinese individuals.

Buy now pay later! The sector is getting bigger, with another major acquisition - this time of a Japanese “by now pay later” platform Paidy, by PayPal for $2.7bn. And speaking of acquisitions, Microsoft has bought a video editing software start-up Clipchamp.

Thank Covid! Vaccine maker Moderna Inc. is having a ball. The stock gained4.73% Tuesday - its fifth consecutive gain - as its price target gets a 77% boost at Morgan Stanely.

Roger that! Swiss running-shoe maker, On Holding AG, backed by tennis great Roger Federer plans to raise $622m - in a New York public offering - of 31.1m shares priced between $18 and $20 per share. The sale will value the shoemaker at $5.5bn.

SEC has threatened Coinbasewith legal action if the company goes ahead with plans to launch the program, allowing users to earn interest by lending Crypto assets.

Endless woes for Crypto! Theturbulentroll-out of Bitcoin as a legal tender in El Salvador, as citizens protest the move, weighed the world’s largest cryptocurrency down. Bitcoin kept tumbling for the second day, losing 13.4% Wednesday morning.

US Markets:

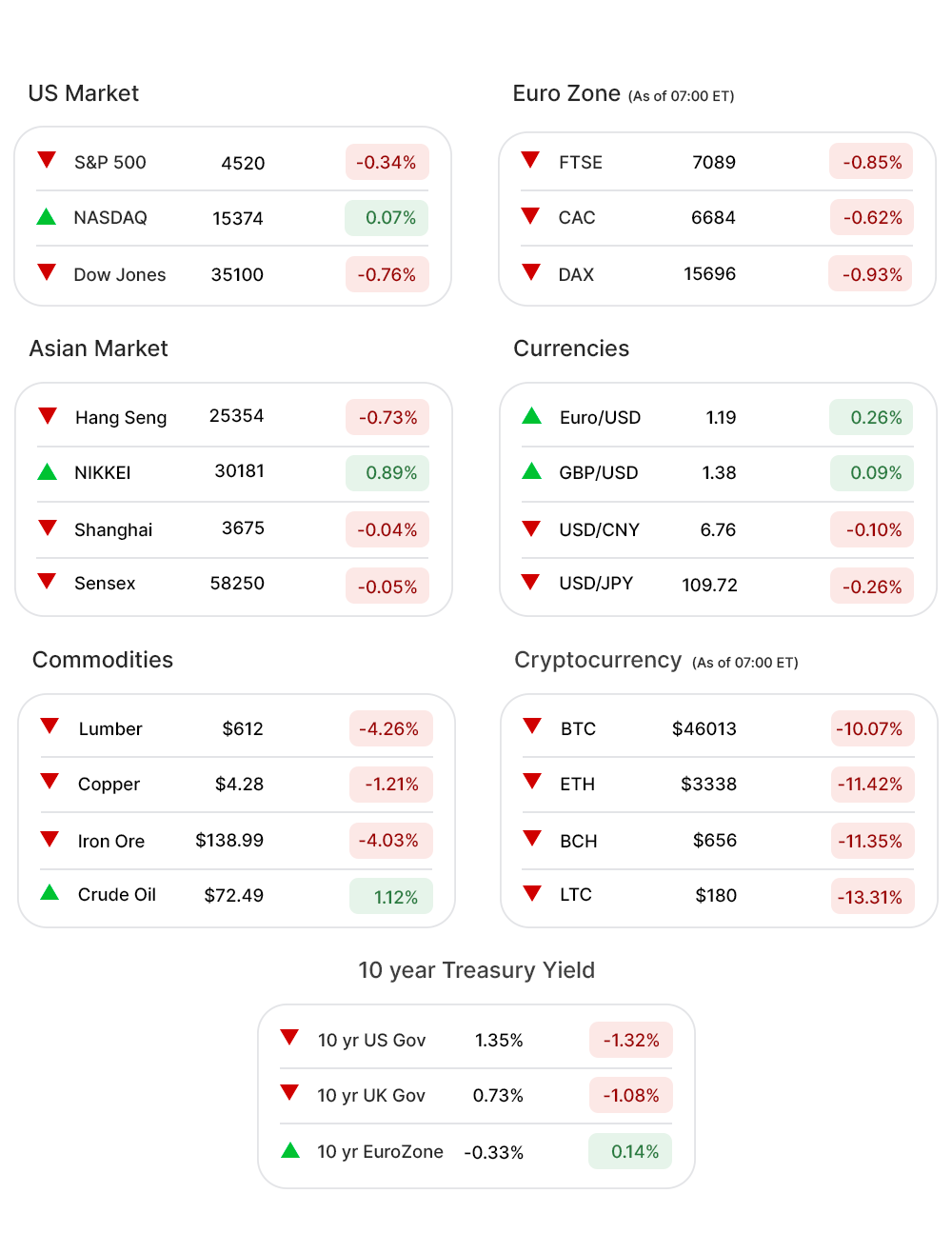

Worries that economic recovery was faltering, amid a rise in Covid cases, the US stocks retreated from record highs Tuesday, with S&P 500 (-0.34%▼) closing at 4520.03.

Dow Jones (-0.76%▼) shed more than 269 points to close at 35100.00, while Russel 2000 (-0.72%▼) closed at 2275.61.

Tech heavy Nasdaq (0.15%▲), was the only major index to eke out some gains, despite the fact that 7 out of ten stocks at the index suffered losses. The rally at Nasdaq was driven by tech giants, including Netflix (NFLX, 2.74%▲), Amazon (AMZN, 0.90%▲), Apple (AAPL, 1.55%▲), Facebook(FB, 1.57%▲), and Alphabet (GOOGL, 0.38%▲).

Sectors at the S&P 500 were mixed, with Consumer Discretionary (0.36%▲), Technology (0.03%▲), and Communication Services (0.44%▲) eking out some gains.

The other 8 sectors were into the red zone. Industrials (-1.77%▼), Materials (-1.34%▼), and Real Estate (-1.13%▼) were at the bottom of the chart.

Other losing sectors included Energy (-0.57%▼), Utilities (-0.80%▼), Financials (-0.57%▼), Consumer Staples (-0.05%▼), and Healthcare (-0.57%▼).

Futures!

The US stock futures looked set to extend the losing streak of Tuesday.

As of 06:30 ET, all the indices were in red, without an exception: Dow Futures (-0.14%▼), Nasdaq Futures (-0.05%▼), S&P 500 Futures (-0.08%▼), and Russel 2000 Futures (-0.11%▼).

Key Movers in Small Cap:

Columbia Property Trust (CXP, 15.18%▲) has been acquired by Pacific Investment Management Company, for $3.9bn. The Relative Volume of the stock was 55.7.

Pliant Therapeutics (PLRX, -0.83%▼) could not sustain the morning momentum gained after the company reported positive data from a phase 2 trial with its experimental fibrosis therapy. The Relative Volume of the stock was 17.0.

The other movers in the small-cap segment included:

Hingham Institution for Savings (HIFS, -0.42%▼): Relative Volume 14.7.

United States Lime and Minerals (USLM, -2.36%▼): Relative Volume 8.3.

Marine Products Corporation (MPX, -9.34%▼): Relative Volume 8.3.

Xoma Corporation (XOMA, -12.53%▼): Relative Volume 6.1.

Cincinnati Bell Inc. (CBB, -0.06%▼): Relative Volume 5.7.

Key Movers in Large Cap:

The Tandem Diabetes Care Inc (TNDM, 13.23%▲) stock will be added to the S&P MIdCap 400 index, effective September 20. The relative volume of the stock was 6.7.

Tinder owner Match Group Inc (MTCH, 7.54%▲) will replace Ireland-based, Perrigo Co. at the S&P 500 index, effective September 20. The relative volume of the stock was 5.6.

Medallia Inc (MDLA, -0.30%▼) announced the expiration of the 40-day “go-shop” period under the terms of the previously announced acquisition of the company by Thoma Bravo, in an all-cash transaction valuing $6.4bn.

The other movers in the large-cap segment included:

MarketAxess Holdings (MKTX, -5.03%▼): Relative Volume 3.0.

Ceridian HCM Holding Inc. (CDAY, 0.13%▲): Relative Volume 3.0.

SEI Investments Company. (SEIC, -4.17%▼): Relative Volume 2.9.

3M Company. (MMM, -4.53%▼): Relative Volume 2.8.

Bently Systems Inc. (BSY, 2.69%▲): Relative Volume 2.8.

Report Card:

Automation software company UiPath Inc (PATH, -1.44%▼) reported a 40% y-o-y increase in revenue to $195.5m, with a profit of a penny a share. Expectations were the company will post a loss of 5 cents per share on revenue of $184.3m. The stock slid around 8% after hours.

Casey’s General Stores Inc (CASY, -1.86%▼) reported an EPS of $3.19, ahead of the estimated $2.83, while revenue of the company came out at $3.18bn, 3.44% ahead of the estimates. The stock climbed a little in extended trading.

Coupa Software Inc (COUP, 0.54%▲) reported a 42% y-o-y increase in revenue to $179m, while the non-GAAP operating income came out at $26.7m compared to a profit of $12.3m for the same period last year. The stock soared more than 5% in extended trading.

On the Lookout:

Job Openings, for the month of July, are expected to remain unchanged at 10.1m, while Consumer Credit for the same period is expected to drop from $38bn to $26bn.

The Beige Book, formally known as the Summary of Commentary on Economic Condition, will be published today.

Unusually high shorter-term CALL options activity seen on Hyzon Motors Inc (HYZN, -10.19%▼), DiDi Global Inc (DIDI, 7.55%▲), Baidu Inc. (BIDU, 2.27%▲), Fox Corp (FOXA, -0.38%▼), and OfferPad Solutions Inc (OPAD, 26.30%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Twitter Inc (TWTR, 0.49%▲), Snowflake Inc (SNOW, 0.80%▲), Marathon Digital Holdings Inc (MARA, -9.26%▼), AMC Entertainment Holdings (AMC, 8.66%▲), and Smartsheet Inc (SMAR, -1.23%▼) among others.

Other Asset Classes:

Crude Oil Prices - with more than 79% of the US Gulf still offline, 9 days after Hurricane Ida crippled production, the slumping Crude Oil prices retracted early Wednesday morning. Brent traded a little over $72 per barrel mark, while WTI Crude was well above the $68 per barrel mark.

The US Dollar (92.61, 0.10%▲) remained bullish as equities retreated amid concerns about the rise in Covid and its adverse effect on global economic recovery.

The US Treasury Yields, following a bullish run on Tuesday, shed some of the gains early Wednesday morning. The 10 Year US Treasury Yield was trading in the red zone at 1.355%.

Global Markets:

Following a mixed day in the US stocks, the Asian Markets were mostly lower on Wednesday as delta variant concerns weighed heavily over the investors’ minds. Shanghai closed 1.08% into the red zone, and Hang Seng fell by 0.27% for the day. Tokyo’s Nikkei was the exception and advanced in excess of 265 points or 0.89%.

European markets followed Asian and the US markets into the red zone as investors have their eyes set on the ECB meeting, scheduled this week. FTSE, slid 0.88% soon after the opening, while CAC was down 1.13%. DAX fell 1.29%, early Wednesday morning even as the pan-EU index Stoxx-600 was also down by more than 1%.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Builders First Source Inc. (BLDR), Matson Inc (MATX), Harmony Biosciences (HRMY), Certara Inc. (CERT), Tenable Holdings (TENB), GDS Holdings (GDS), and Nutanix Inc (NTNX). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Tomorrow, same time!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.