The Trade-Supply Paradox!

Good morning!

We wondered how trade is booming amid supply chain constraints. A close analysis of the recent OECD report shows an exponential export growth in commodities producing nations, between the last two quarters, owing to increasing prices, limited global supply, and strong demand. Australia’s exports have grown by 10%, Russia’s by 30.7%, and Brazil’s exports by 29.4%. Manufacturing powerhouses like China and Germany have had their exports scuttled.

Make way for the Trillions! The $3.5tr spending package moves another step closer to being a reality as Congress Tuesday passed the budget blueprint, setting the stage for Democrats to enact President Biden’s agenda.

The rich are getting richer!$357bnfrom the historic $650bn IMF package has gone to 40 of the wealthiest countries in the world. Emerging and developing countries got $275bn, while the poorest were given just $21bn from the package.

Charity begins at home! US-listed Pinduoduo, the Chinese agriculture-focused technology platform, has pledged to give away$1.5bn in charity from future revenue - in sync with President Xi’s call for “common prosperity”. The stock jumped 22%, as the company also announced its first quarterly profit.

July New Home Sales have declined 27.2% y-o-y, in wake of surging prices and tighter supplies. The Single-family home sales have however increased by 1%, after three consecutive months of decline.

US Markets:

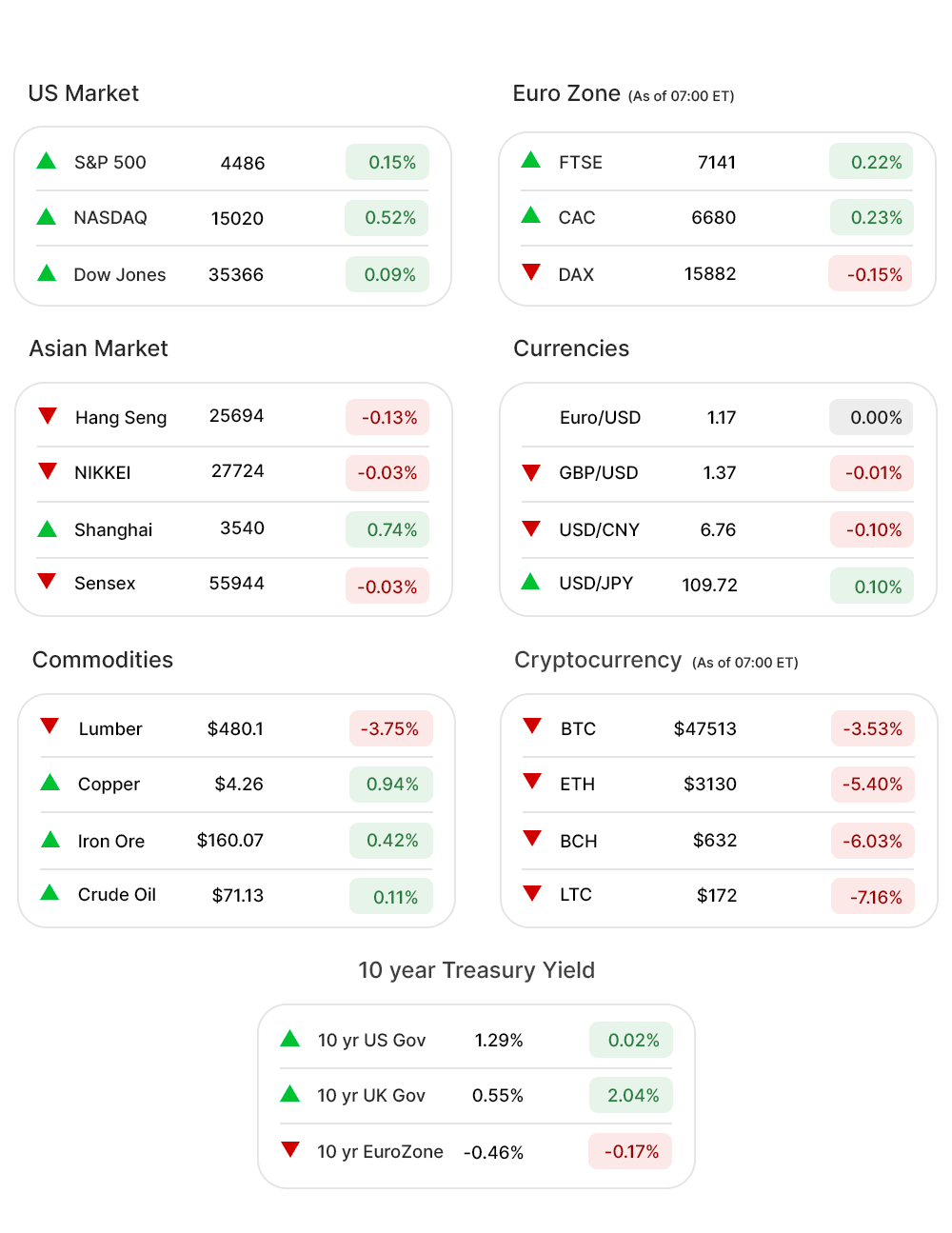

Shares of banks, oil producers, and travel companies propelled stocks Tuesday, with S&P 500 (0.1%▲) notching its 50th record close of the year, 9th in the month of August.

Nasdaq (0.5%▲) rose 77.15 points to close over 15000 for the first time. Dow Jones (0.1%▲) gained over 30 points, while Russel 2000 (1.02%▲) climbed more than 22 points.

The green stocks at S&P 500 outnumbered the red ones by one.

Energy (1.61%▲) continued to be the highest gainer, for the second day in a row. Other sectors making gains for the day included Consumer Discretionary (0.76%▲), Communication Services (0.41%▲), Financials (0.67%▲), Industrials (0.53%▲), and Materials (0.67%▲).

Healthcare (-0.35%▼), Consumer Staples (-0.76%▼), Real Estate (-0.72%▼), Technology (-0.13%▼), and Utilities (-0.63%▼) were the losing sectors.

Futures!

The Futures advanced further Wednesday morning.

As of 06:30 ET, Futures were green without an exception: Russell 2000 Futures (0.18%▲), Nasdaq Futures (0.06%▲), S&P 500 Futures (0.05%▲), and Dow Futures (0.06%▲).

Key Movers in Small Cap:

Triple-S Management Corp (GTS, 45.51%▲), a provider of healthcare services, announced that it will be acquired by GuideWell Mutual Holding in an all-stock deal worth $900m or $36 per share. The relative volume of the stock was 98.9.

Cara Therapeutics (CARA, 4.20%▲) and Vifor Pharma announced that their injection KORSUVA has been approved by the FDA for injection in the treatment of Pruritus, associated with Kidney disease. The relative volume of the stock was 19.6.

A phase IIb study evaluating oral JAK-inhibitor candidate, Izencitinib of Theravance Biopharma (TBPH, -34.79%▼), has failed to meet its endpoints. The relative volume of the stock was 16.6.

Skywater Technology Inc (SKYT, 30.35%▲) announced an expanded deal regarding wearable health sensors. The relative volume of the stock was 6.0.

The other movers in the small-cap segment included:

Oyster Point Pharma. (OYST, 0.45%▲): Relative Volume 11.5.

Bluegreen Vacations Holdings. (BVH, 0.96%▲): Relative Volume 10.8.

Escalade Incorporated. (ESCA, 0.86%▲): Relative Volume 7.1.

Workiva Inc. (WK, 2.66%▲): Relative Volume 4.6.

Key Movers in Large Cap:

GameStop Corp (GME, 27.53%▲)Tuesday led the meme-stock rally with a relative volume of 11.1.

Palo Alto Networks Inc. (PANW, 18.60%▲) registered its best-ever trading Tuesday, a day after it announced better than expected financial results. The relative volume of the stock was 7.9.

Santander Consumer USA Holdings (SC, 0.77%▲) will be taken private by the majority shareholder Santander Holdings, in a $2.5bn deal. The relative volume of the stock was 7.6.

The security software company Crowdstrike Holdings Inc (CRWD, 8.07%▲) will be added to the Nasdaq-100 index. The relative volume of the stock was 3.7.

The other movers in the large-cap segment included:

Best Buy Co Inc(BBY, 8.32%▲): Relative Volume 5.0.

New Residential Investment. (NRZ, 6.09%▲): Relative Volume 3.7.

Cousins Properties Inc. (CUZ, 0.80%▲): Relative Volume 3.2.

Brown-Forman Corporation. (BFB, 0.43%▲): Relative Volume 2.9.

Report Card:

Best Buy Co Inc(BBY, 8.32%▲) announced non-GAAP earnings of $2.98 per share, up 70.3% y-o-y, and beating the estimates of $1.85 per share. The revenue rose 19.6% y-o-y to $11.85bn, ahead of the estimated $11.46bn. The stock remained in the green zone after hours.

Advanced Auto Parts (AAP, 0.004%▲) reported an adjusted EPS of $3.40 on revenue of $2.65bn, beating the estimates of $2.95 on revenue of $2.61bn. The earnings stood at $178.7m. The stock climbed a little after hours.

Nordstrom Inc (JWN, 3.11%▲) came out with earnings of $0.49 per share, beating the estimates of $0.26 per share, way ahead compared to the loss of $1.62 per share a year ago. The revenue of $3.66bn surpassed the estimates by 8.14%. The stock slid by 8% after hours.

Pinduoduo Inc (PDD, 22.25%▲) reported an 89% y-o-y increase in revenue to $3.6bn, while the net income came out at $371m, compared to a net loss of $139m last year. The stock climbed a little after hours.

On the Lookout:

Durable Goods Orders are expected to slide down to -0.5% from the previous reading of 0.9%. Non-defense Capital Goods Orders (excluding aircraft) had a previous reading of 0.7%.

Unusually high shorter-term CALL options activity seen on Analog Devices Inc (ADI, -2.23%▼), Gap Inc (GPS, 2.47%▲), American Eagle Outfitters Inc. (AEO, 3.35%▲), and Nvidia Corporation (NVDA, -0.75%▼), among others.

On the other hand, unusually high shorter-term PUT options activity was seen on GDS Holdings Ltd(GDS, 5.85%▲), AMC Entertainment Holdings (AMC, 20.44%▲), Splunk Inc (SPLK, 5.47%▲), Airbnb Inc (ABNB, 9.97%▲), and Pinduoduo Inc. (PDD, 22.25%▲) among others.

Other Asset Classes:

Crude Oil Prices - slid a little Wednesday morning after making a strong comeback from last week’s rout. Brent was 0.18% down by traded above the $70 per barrel mark.

The US Dollar (93.04, 0.16%▲) seems to be stabilizing again after a bounceback in crude oil prices put pressure on the greenback.

The US Treasury Yields continued to build on gains made following the FDA approval to Pfizer-BioNTech Covid vaccine and ahead of Fed’s annual Jackson Hole Symposium, to be held on Thursday. The 10 Year US Treasury Yield was trading at the 1.292% mark, early Wednesday morning.

Global Markets:

After a strong start to the week, some of the major indices in Asian markets pulled back a little Wednesday, but the sentiment remained upbeat. Shanghai gained more than 25 points or 0.74% while Hang Seng slid by well over 100 points. Nikkei, though flat, was below the zero mark.

Travel stocks in European markets rose for the fourth day, giving an early impetus to the stocks. The stocks were also supported by the expectation that data from Germany will show business morale was further boosted in August. Major indices, barring DAX, were in green early Wednesday morning.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Head Hunter Group. (HHR), Workiva Inc (WK), Synaptics Inc. (SYNA), and Monolithic Power Systems (MPWR). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.