The Trillion Dollar Injection!

Good Morning,

Spot-on! Many more trade setups identified by our AI reached their respective profit targets yesterday, within their optimal holding period: Consol Energy Inc. (CEIX), Caravana Co. (CVNA), Hannon Armstrong Sustainable Infrastr Cap (HASI), Premium Brands Holdings (PBH), Pfizer Inc. (PFE), and Albertsons Companies Inc (ACI). Signup, we have a 30-day free trial.

The starter before the main course! The historic $1tr Infrastructure Bill has been approved by the US Senate, Tuesday. After the House test, the bill will become President Biden’s first bipartisan win. The money will be spent on roads, bridges, internet, universal schooling and housing.

The $3.5tr buffet! Framework for the $3.5trbudget plan - that would expand Medicare and Climate initiatives among other things - has also been passed.

Another one for history! In possibly the biggest CryptoCurrency theft ever, $600m have been stolen by hackers as they exploited a vulnerability in Poly Network, a platform that looks to connect different blockchains. The company, through Twitter, is seeking to establish communication with the hackers.

Commonwealth Bank of Australia, largest lender in the country, is giving back a record$7bn in buybacks and dividends to investors as an economic recovery from the pandemic has led to boosting bank coffers to record levels.

Not so optimistic! Concerns over labor shortage and supply-chain disruptions have subdued the optimism of small business owners vis-a-vis US economic recovery. The Small Business Optimism Index has slid to 99.7, giving up the 2.8 points June gain.

Singapore has upgraded its growth outlook for the year from 4% to 6% to a new projection of6% to 7% as Covid situation eases and vaccination numbers grow. The country’s economy grew 14.7% in Q2 of 2021, from a year ago.

US Markets:

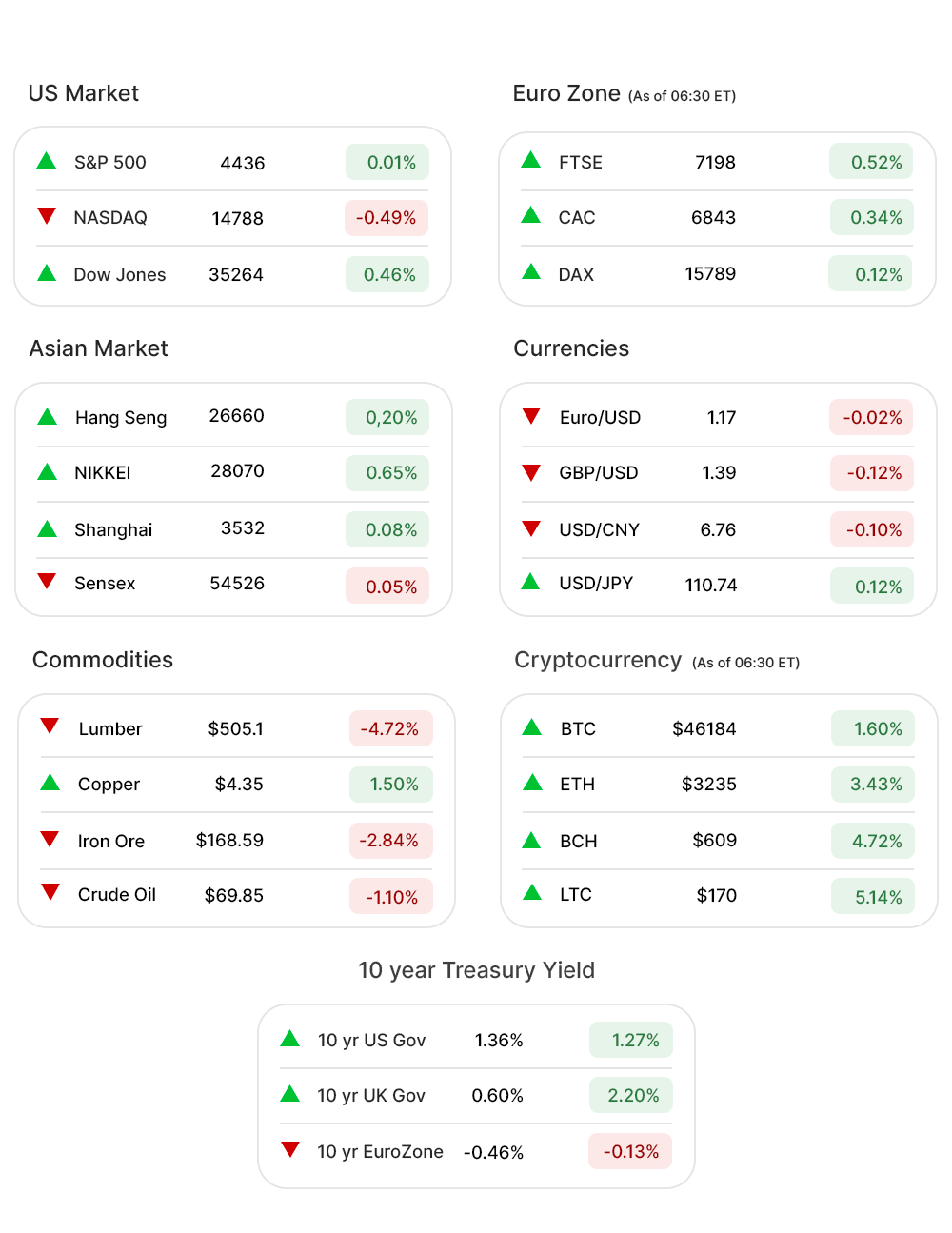

Buoyed by the landmark infrastructure bill, the stocks in the US eked upwards with S&P 500 (0.16%▲) and Dow Jones (0.16%▲) reaching record highs, gaining 4.40 and 162 points respectively.

A rebound in oil prices, after Monday’s slump, also helped the markets reach higher.

Nasdaq (-0.49%▼) was, however, weighed down by losses in big-tech companies including Apple (AAPL, -0.34%▼), Facebook (FB, -0.13%▼), Amazon (AMZN, -0.63%▼), Alphabet (GOOGL, -0.07%▼), and Nvidia (NVDA, -1.77%▼).

Sectors were mixed at the S&P 500 with three of them in red and the rest eight in green.

Energy (1.72%▲), Financials (1.01%▲), Industrials (1.01%▲), and Materials (1.48%▲) advanced considerably followed by smaller gains in Communication Services (0.09%▲), Consumer Staples (0.71%▲), and Utilities (0.10%▲).

Real Estate (-1.10%▼), Healthcare (-0.24%▼), and Technology (-0.73%▼) slid for the day.

Futures!

The Futures edged lower, Wednesday morning, without exceptions in the major indices.

As of 06:00 ET, only Nasdaq Futures (-0.21%▼), S&P 500 Futures (-0.17%▼), Russell 2000 Futures (-0.27%▼), and Dow Futures (-0.10%▼) were all red.

Key Movers in Small Cap:

Fulcrum Therapeutics (FULC, 125.33%▲), an early-clinical stage biopharma, came up with an encouraging read out from a clinical trial of its lead candidate FTX-6058, used in treatment for Sickle Cell disease. The relative volume of the stock was 469.6.

Exagen Inc (XGN, 24.59%▲), reported a 43% y-o-y increase in revenue to $12.8m, considerably higher than the estimated $11.48m. The loss of $0.38 per share was also ahead of the estimated $0.44. The relative volume of the stock was 16.1.

3D Systems Corporation (DDD, 21.48%▲), reported a 44% growth in revenue for Q2 to $162.6m from the prior year’s $112.8m. The relative volume of the stock was 15.3.

A company dealing in innovative robotic technology, Stereotaxis Inc (STXS, -21.26%▼) reported Q2 revenue of $9.1m, up 70% y-o-y and 5% sequentially. The relative volume of the stock was 12.5.

Reata Pharmaceuticals(RETA, -18.12%▼) reported a 28% drop in revenue y-o-y to $2.22m and a net loss of $72.7m or $2 per share, a bit deeper than last year’s loss of $67.6m. The relative volume of the stock was 12.0.

The pay-per-mile car insurance company, Metromile Inc(MILE, -22.53%▼) reported a loss of $0.33 per share on revenue of nearly $29m, beating estimates. But the company’s full-year outlook failed to impress the investors. The relative volume of the stock was 11.2.

The other movers in the small-cap segment included:

AerSale Corp (ASLE, 10.60%▲) : Relative Volume 12.2.

comScore Inc. (SCOR, -22.58%▼): Relative Volume 10.8.

Fisker Inc (FSR, 21.56%▲): Relative Volume 8.5.

Casper Sleep Inc. (CSPR, -16.76%▼): Relative Volume 7.3.

Key Movers in Large Cap:

Oak Street Health (OSH, -12.92%▼) reported a 65% increase, y-o-y, in revenue to $353.1m. However, the Q2 net loss of $100.3m or $0.44 per share was way higher than the estimated net loss of $0.34 per share. The relative volume of the stock was 7.6.

SVB Financial Group(SIVB, -1.07%▼) has announced the pricing of its underwritten public offering of 2.2m shares of common stock, at $564 per share. The relative volume of the stock was 6.7.

The Grocery company, Albertsons Companies (ACI, 17.18%▲) has announced key hiring. Sharon McCollam will replace Bob Dimond as the President and chief financial officer. The relative volume of the stock was 5.2.

WP Carey Inc (WPC, -3.81%▼) has announced the pricing of its underwritten public offering of 4.5m shares of common stock. The relative volume of the stock was 5.0.

The other movers in the large-cap segment included:

Signify Health Inc. (SGFY, -9.82%▼): Relative Volume 5.1.

Heico Corporation. (HEIA, 2.91%▲): Relative Volume 4.7.

Kansas City Southern (KSU, 7.47%▲): Relative Volume 3.5.

TuSimple Holdings Inc (TSP, -3.90%▼): Relative Volume 3.4.

Report Card:

The soft drink giant Coca-Cola (COKE, 1.52%▲) reported Q2 earnings of $48.2m or an EPS of $5.12 while earnings, adjusted for non-recurring costs, were $8.77 per share, with a revenue of $1.43bn in the period. The stock was flat after hours.

The CryptoCurrency exchange operator, Coinbase Global Inc (COIN, -3.85%▼) crushed estimates and reported an EPS of $3.45 way ahead of the expected $2.33. The revenue of $2.23bn was well ahead of the estimated $1.78bn as well. The stock advanced by a little shy of 1% after hours.

The information technology company, Super Micro Computer Inc (SMCI, -0.85%▼) reported fiscal Q4 net earnings of $39.2m or 74 cents per share. The revenue for the quarter was $1.07bn for the period. The stock slid further after hours.

The marketer and distributor of food products, Sysco Corporation (SYY, 6.52%▲) reported an 82% y-o-y increase in sales to $16,136.9m, beating the estimates of $14,560m comfortably. The EPS of 74 cents was also ahead of the estimated 57 cents. The stock was flat after hours.

On the Lookout:

The much-awaited inflation data, gauged by the Consumer Price Index, will be updated today and is expected to go down to 0.5% from the previous 0.9%. Core CPI is expected to go down to 0.4% from 0.9%.

An update on Federal Budget Balance is due today as well and the print is supposed to go down from -$63bn to -$314bn.

Unusually high shorter-term CALL options activity seen on Lightning Emotors Inc (ZEV,80.97%▲), Snap Inc (SNAP, -3.01%▼), Alnylam Pharmaceuticals . (ALNY, 3.74%▲), Lucid Group Inc (LCID, 4.09%▲), and RealReal Inc (REAL, -17.99%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Pfizer Inc. (PFE, 4.81%▲), Utz Brands Inc (UTZ, 0.19%▲), 1-1800-Flowers.Com Inc (FLWS,2.50%▲), Under Armour Inc. (UA, 2.06%▲), and General Electric Company (GE, 2.29%▲) among others.

Other Asset Classes:

Crude Oil prices remained more or less static, even after analysts downgraded China’s fuel demand, in wake of the travel restrictions imposed in the country. The prices had climbed considerably on Tuesday, after Monday’s rout. Brent continued to hover near the $70 level, early Wednesday morning - while the WTI Crude climbed 0.44%.

The US Dollar (93.17, 0.12%▲) remained firm amid the taper-talks by the Fed. The US dollar has, since the beginning of the year, outperformed eight of its peers from among the group of ten, barring the Canadian dollar and the Pound Sterling.

US Treasury Yields ahead of the Inflation data soared further up Wednesday morning. The 10 Year US Treasury Yield was trading at 1.362% early Wednesday morning, and the 30 Year Treasury Yield breached the 2% mark and was trading at 2.004%.

Global Markets

The Asian Markets were a mixed bag as all eyes remained fixed towards Wall Street, ahead of the inflation data - considered to be a glimpse into how the world’s biggest economy was healing. Nikkei rose more than 180 points while Shanghai was up marginally by 0.08%. Hang Seng advanced 37 points but Kospi in Seoul gave up 0.8%.

Gains in Banking and Mining stocks further elevated the already upbeat sentiment in European markets, which climbed to newhighsWednesday morning. The EU markets are set for the longest winning streak since June.The pan EU index Stoxx-600 rose 0.2%, early morning today and was in the green zone for the eighth consecutive day.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Have a lovely day ahead!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.