The Unrelenting Inflation!

Good Morning,

Here is something to cheer about! IRS will be handing out around $4 million in surprise tax refunds to many reeling under financial distress amid the pandemic.

Is inflation really transitory? With used cars and trucks accounting for more than one-third of the surge in prices, the coreCPI rose to 4.5%, the highest since 1991.

Apple might roll out a “buy now, pay later” plan and just the mention of it has sent this thriving sector (buy now, pay later) tumbling. The BNPL industry has boomed as online shopping saw exponential growth during the pandemic,

Boeing has run into some rough weather, again! The FAA has said it has found some problems near the nose of some 787 Boeing airplanes, that are still undelivered. The Boeing stock tumbled 3%.

US Markets:

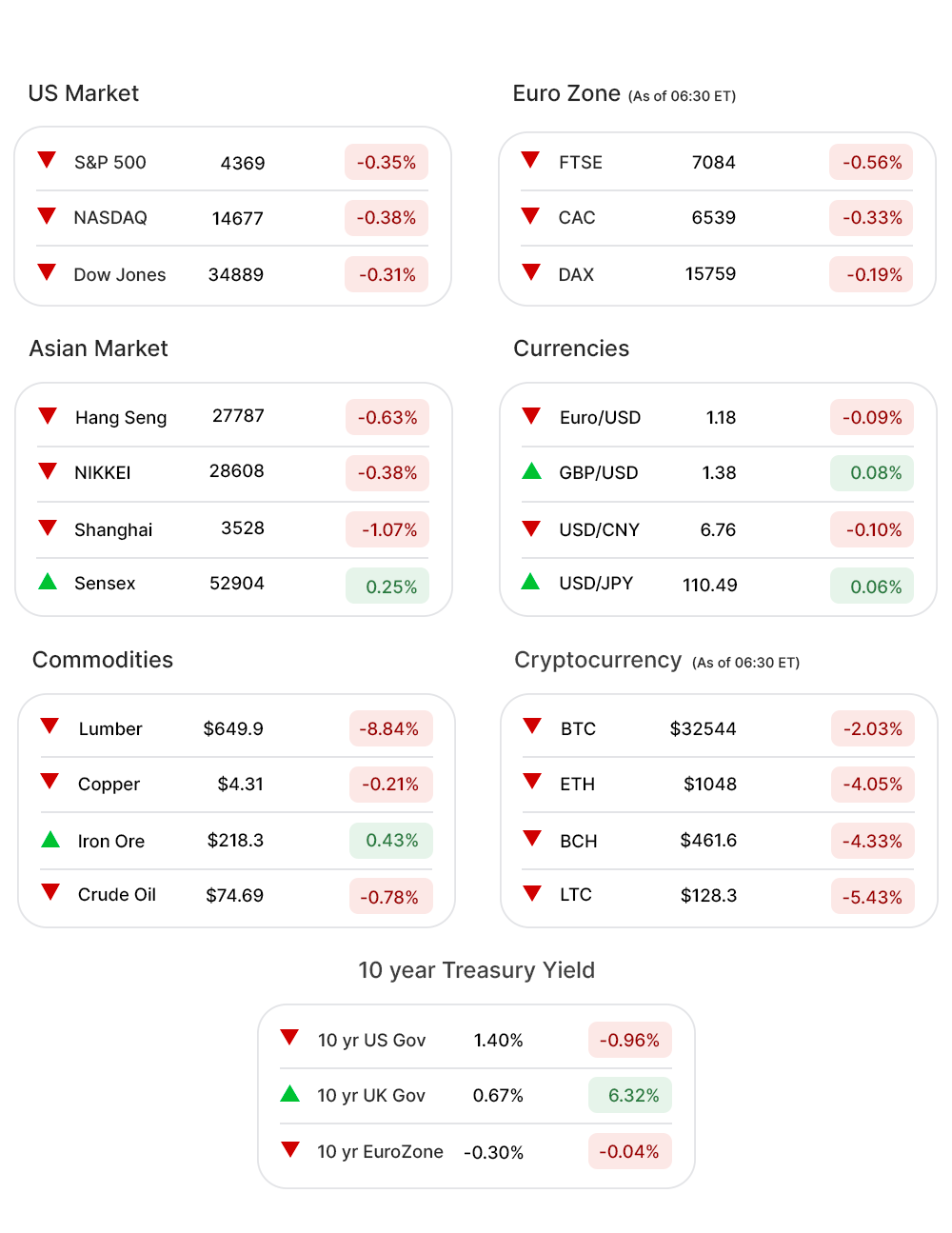

The markets were hit to below sub-zero levels on Tuesday, from record positions Monday, as inflation measured by the Consumer Price Index (CPI) for June jumped to 5.4%, a 13 year high.

All major indices were red. S&P 500 (-0.35%▼) lost the gain of 15 points made on Monday. Tech heavy Nasdaq (-0.38%▼) lost more than 55 points while Dow (-0.31%▼)slumped by 107 points.

Surprisingly, the Technology (0.44%▲) sector was unfazed by the chaos around and continued its green run! However, among the Tech giants, only Apple (AAPL, 0.44%▲) and Alphabet (GOOGL, 0.44%▲) could cash in on the run on Tuesday.

Amazon (AMZN, -1.11%▼), Facebook (FB, -0.30%▼) and Nvidia (NVDA, -1.28%▼) followed the index rather than the sector.

Industrials (0.10%▲) and Consumer Discretionary (0.59%▲) were the only other sectors that followed Technology into the green zone.

The rest of the eight sectors hovered below the sub-zero levels, with Financials (-1.06%▼) and Real Estate (-1.31%▼), tumbling more than 1%. Energy (-0.70%▼), Materials (-0.95%▼), Utilities (-0.76%▼), and Healthcare (-0.11%▼) were the other losers.

Futures!

Futures were flat for the most part after hours but ventured into the green zone, Wednesday morning.

As of 07:00 ET, only Nasdaq Futures (0 .33%▲), S&P 500 Futures (0 .06%▲), Russell 2000 Futures (0 .23%▲) were all green while Dow Futures (-0.01%▼) still hovered in the sub-zero level.

Key Movers in Small Cap:

The Maryland bank holding company, Howard Bancorp Inc. (HBMD, 26.70%▲), has announced that it will be acquired by FNB Corporation in an all-stock deal, valued at $418 million. Howard is up more than 100% over the past year. The relative volume of the stock was 73.3.

Middlesex Water Company (MSEX, 13.66%▲), the water utility firm, announced on Tuesday that its stock will soon be trading on the S&P SmallCap 600. The relative volume of the stock was 13.1.

State Auto Financial Corporation (STFC, -0.46%▼), the property and casualty insurance company shrugged off a small portion of mammoth gains made on Monday, following the news of its acquisition by Liberty Mutual. The relative volume of the stock was 9.6.

Two Harbors Investment (TWO, -9.14%▼), a real estate investment trust, on Tuesday announced that it has priced a public offering of 40 million shares of its common stock, for expected gross proceeds of $260 million. The relative volume of the stock was 7.4.

Other stocks among the movers in this category included, IRadimed Corporation (CLNN, 20.85%▲), with a relative volume of 15.1; Clene Inc (CLNN, 4.14%▲), with a relative volume of 8.3 and Actus Medical Inc. (AFIB, 0.45%▲) with a relative volume of 7.2.

Key Movers in Large Cap:

FNB Corporation (FNB, -3.61%▼), a diversified financial services company, has announced its acquisition of Howard Bancorp Inc. The stock followed the Financial sector and was not buoyed by the news like Howard was. The relative volume of the stock was 3.8.

Conagra Brands (CAG, -4.3%▼), a consumer packaged goods holding company, was bogged down by the inflation concerns and its own below-par performance as the earnings report suggested a 16.7% slump in net sales for the fourth quarter, though slightly better than the expected sales. The relative volume of the stock was 3.0.

Ahead of its earnings report on Thursday and despite an expected spike in the sales, the business services company Cintas Corporation (CTAS, -2.83%▼) faltered a little on Tuesday. The relative volume of the stock was 2.7.

News of share dilution fuelled the plunge of Solar energy systems specialist, Shoals Technologies Group (SHLS, -14.37▼). The company on Monday, after hours, had announced the selling of 13.4 million new shares in common stock. The relative volume of the stock was 2.5.

The other key movers in this segment included, New Residential Investment (NRZ, -4.36▼), with a relative volume of 2.7 and IAA Inc (IAA, 0.42%▲), with a relative volume of 2.5.

Report Card:

The earnings season has begun amid rising worries about inflation. Tuesday marked the first announcements of this season with some banking giants announcing their results.

JP Morgan Chase (JPM, -1.72%▼) has beaten the estimates, with an EPS of $3.78 versus predicted $3.21 and revenue of $31.4 billion against the $29.9 billion estimates. The largest US bank, by assets, has reported an income of $11.9 billion up $7.3 billion from a year ago. The stock however followed the Financials sector and slid below sub-zero levels. It was in red after hours as well, by 0.45%.

Propelled by strong performance in investment banking and a thriving IPO market, another banking giant Goldman Sachs (GS, -1.19%▼) posted its second-highest revenue quarter of $15.3 billion ever, only behind the first quarter of 2021. The EPS of $15.02 per share has beaten estimates of $10.24 by a long shot. The stock fell, though, amidst concerns of sustaining revenues from investment banking, and was negative even after hours.

The beverages and snacks giant, Pepsi Co. (PEP, 2.31%▲) beats posting net sales of $19.2 billion versus expected $17.94 billion. The diluted EPS of $1.72 also topped the estimate of $1.53. The stock remained in the green after hours, as well.

On the Lookout:

The Producer Price Index (PCI), measuring the price changes in what suppliers are charging producers and other businesses, will be updated today at 8:30 AM ET for the month of June. For May the PCI was 0.8% and added to inflation pressures considerably. The average rise between 2017 and 2019 was 0.2%.

Fed Chair, Jerome Powell, is scheduled to testify before the House Committee on Financial Services vis-a-vis the monetary policy.

The Beige Book, formally a report on economic conditions published eight times a year by the Fed ahead of the Open Market Committee meeting, is due to be published today at 2:00 PM ET.

Unusually high shorter-term CALL options activity seen on Snowflake Inc (SNOW, -0.92%▼), FireEye Inc (FEYE, -2.02%▼), Occidental Petroleum Corporation (OXY, 0.30%▲), and PepsiCo (PEP, 2.31%▲), Veeva Systems (VEEV, -0.54%▼) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Tilray Inc (TLRY,0.49%▲), Tesla Inc (TSLA,-2.50%▼), ArcelorMittal SA (MT, -1.93%▼), Arista Networks (ANET,-0.25%▼), and Conagra Brands (CAG,-5.43%▼) among others.

Other Asset Classes:

The 10 Year US Treasury Yield, had a delayed reaction to the 13-year leap in CPI index, fuelling inflation worries to new highs. After remaining flat for the most part of the day the yield on the benchmark 10 Year Treasury note increased 4.6 basis points to reach 1.412% (Monday, 4:00 pm ET). The yield on the 30 Year Treasury note also increased by 4.5 basis points to 2.038% at around the same time. Some of the gains have been shrugged off, since.

The US Dollar (92.63,-0.13%▼) shed some of the gains it made on Tuesday soon after the print on CPI index showed a 13 year high. The greenback touched 92.83 and was at a 3 month high against the Euro.

Crude Oil gained around 2% on Tuesday after the International Energy Agency said the market should expect supply tightening, for now, in wake of disagreements among major oil producers on how much additional crude to ship worldwide. However, some of the gains were shed Wednesday morning after a drop in China’s Crude imports, down 3% from January to June compared to the last year. This is the first such drop since 2013.

Global Markets:

The Asian Markets have yet again followed the US markets as inflation worries gain momentum, and have mostly slumped today giving up the gains made for almost two trading sessions. Nikkei and Hang Seng lost 109 and 175 points in that order as Shanghai, also in the red zone, lost more than 38 points today. Worries around the rising cases of Delta Variant are also weighing down the markets in Asia Pacific.

The Stoxx-600 hovered just below the flat as some major indices in the European Markets were amidst a gloomy day, while this report was being written, following the trend in the US and widespread inflation concerns. CAC had lost 18 points, DAX more than 28 points and FTSE was down by over 30 points as at 5:00 am ET.

Meanwhile on Researchfin.ai

There were 5 new trade setups identified by the AI yesterday. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

Have a good day!

See you on Thursday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.