The Vanishing Billions!

Good Morning,

Our App is successfully identifying new trade setups everyday. Do have a look!

The dragon is no more spewing fire! The Nasdaq Golden Dragon China Index - which tracks 98 of China’s biggest firms listed in the US - has plummeted 15% in two days, Friday and Monday, its worst dip since 2008. $769bn has been wiped off the US-listed Chinese firms in 5 months as China continues its crackdown on the Tech giants.

And they are not alone! China has now issued guidelines for food delivery platforms as well, asking them to ensure the delivery workers earn at least local minimum income. The fresh guidelines wiped off $60bn from Meituan, one of China’s biggest food delivery platforms, in just two trading sessions.

Covid-19 vs Tokyo-2020! On Tuesday Tokyo city reported 2848 new cases of CoronaVirus infections, almost double the number last Tuesday and highest ever since the pandemic began. Nikkei kept rising!

The European equities slid after Reckitt Benckiser, the multinational consumer goods group, warned of cost pressures and price increases - stoking fears of inflation caused by disrupted supply chains might become an ongoing problem.

US Markets:

Investors looked ahead to the big-tech earnings past concerns over the growth outlook in the wake of rising delta variant cases, pushing the major US indices to record levels at close Monday.

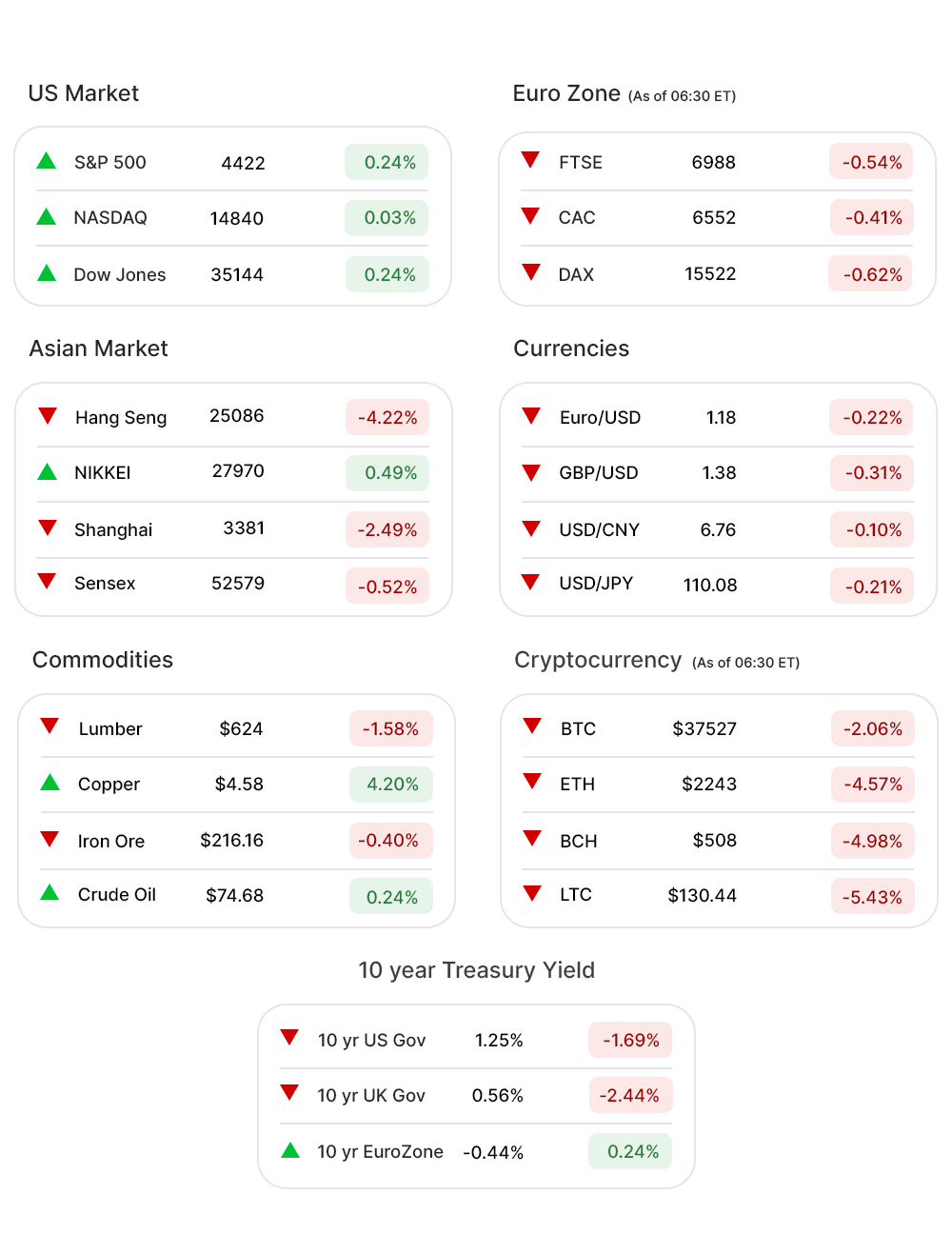

The S&P 500 (0.24%▲) closed at a record 4422. Tech-heavy Nasdaq (0.03%▲) reached 14841 and the Dow (0.24%▲) climbed 82 points to reach 35144.

Technology (-0.02%▼) shed a little gains made consistently over the past weeks, ahead of the tech earnings. Healthcare (-0.62%▼) was the only other sector in red.

All other 9 sectors at the S & P 500 made gains, with Energy (2.49%▲) bouncing right back and leading the pack of the gainers. Materials (1.56%▲), Utilities (1.27%▲), Financials (0.54%▲) and Consumer Discretionary (0.77%▲) were among the gainers as well.

The turbulence continued in some US listed Chinese stocks - including Gaotu TechEdu Inc (GOTU, -28.98%▼) and Tal Education Group (TAL, -26.67%▼) - following the crackdown on for-profit education companies.

Futures!

Dow Jone Futures lost more than 150 points pre-market as other indices followed with smaller declines. Whether the losses will extend into the day’s trade remains to be seen.

As of 06:30 ET: Nasdaq Futures (-0.12%▼), S&P 500 Futures (-0.29%▼), Russell 2000 Futures (-0.61%▼), and Dow Futures (-0.39%▼) looked gloomy.

Key Movers in Small Cap:

Ball and roller bearing manufacturing company, RBC Bearings Inc (ROLL, 16.22%▲), has announced that it will acquire DODGE Mechanical Power Transmission Division of ABB Ltd. for $2.9bn in cash. The relative volume of the stock was 8.8.

Atlantic Capital Bancshares (ACBI, 2.48%▲) stock continued to rise after it announced that it will be merged with and into South State Corp, in a deal worth $542m or $26.43 per share. The relative volume of the stock was 7.2

Denali Therapeutics (DNLI, -15.27%▼) had on Sunday presented interim results from its phase 1/2 study evaluating experimental enzyme replacement therapy, DNL310, in treating the rare neurodegenerative Hunter Syndrome. The company had touted the interim data as “positive”. The relative volume of the stock was 6.1.

The pumps and pumping equipment company, SPX Flow Inc (FLOW, 8.70%▲), announced it has hired bankers to explore whether any bidder was willing to pay up for its growth potential. The relative volume of the stock was 5.5.

Riot Blockchain (RIOT, 21.00%▲), a cryptocurrency mining company, soared following the Bitcoin rally towards $40k. The relative volume of the stock was 3.7.

The other movers in the small-cap segment included:

Eiger Biopharmaceuticals (EIGR, -2.71%▼): Relative Volume 5.8.

ALX Oncology Holdings (ALXO, -3.90%▼): Relative Volume 5.2.

Capstead Mortgage (CMO, 6.09%▲): Relative Volume 4.0

Spruce Biosciences (SPRB, 4.71%▲): Relative Volume 3.9.

Old Second Bancorp (OSBC, -0.17%▼): Relative Volume 3.6.

Key Movers in Large Cap:

Enterprise software firm, Medallia Inc. (FB, 5.30%▲), announced Monday that the private equity firm Thoma Bravo will take the company private for $6.4bn in cash. The relative volume of the stock was 13.3.

A seller of financial risk mitigation products, Aon Plc (AON, 8.21%▲) and Willis Towers Watson have announced the termination of their business combination agreement, made in March 2020, and end litigation with the US Department of Justice. Aon will pay a $1bn termination fee to Willis. The relative volume of the stock was 8.0.

The scrapping of this $30bn merger, between these insurance brokers, pushed the Willis Towers Watson (WLTW, -8.98%▼) stock well below the zero mark. The relative volume of the stock was 7.0.

Brookfield Asset Management (BAM) and Brookfield Property REIT Inc (BPYU, -0.86%▼) have announced that BAM has completed its acquisition of all of the limited partnership units of BPYU. The relative volume of the stock was 7.7.

Hasbro Inc. (HAS, 12.24%▲) reported strong Q2 earnings with an EPS of $1.05 beating estimates of 50 cents, comprehensively. The relative volume of the stock was 5.8.

The other movers in the large-cap segment included:

Discovery Inc. (DISCK, 3.88%▲): Relative Volume 4.3.

PerkinElmer Inc (PKI, 4.73%▲): Relative Volume 3.1.

PG&E Corp. (PCG, -5.10%▼): Relative Volume 2.9.

Lockheed Martin (LMT, -3.34%▼): Relative Volume 2.8.

Report Card:

The big tech earnings have begun with Tesla Inc (TSLA, 2.21%▲) beating the estimates with ease. The record-setting deliveries for June have propelled the revenue of the company to $11.96bn, ahead of the estimated $11.37bn and $6.04bn y-o-y. The adjusted EPS of $1.45 has outperformed the estimate of 97 cents as well as 44 cents of the prior year. The stock soared after hours as well. The EV maker has surpassed a net income of $1bn for the first time, reporting $1.14bn in (GAAP) net income for the quarter, ten times more y-o-y.

A provider of semiconductor packaging, AMKOR Technology (AMKR, -0.17%▼), has reported net sales of $1.41bn, a 20% increase y-o-y with a Q2 income of $126m or a diluted EPS of $0.51. The stock jumped to a little shy of 3% after hours.

Ameriprise Financial (AMP, 0.91%▲) reported an adjusted operating net revenue of $3.4bn for Q2, a 22% increase y-o-y. The adjusted diluted EPS of $5.27 was 39% ahead of the prior year. The stock however tumbled by more than 2% after hours.

The manufacturer of elevators and escalators, Otis Worldwide (OTIS, 0.59%▲) reported an EPS of $0.79 for Q2, beating the estimates of $0.71. The $3.7bn revenue is 7.08% more than what was expected of the company. The stock remained flat after hours.

Universal Health Services Inc (UHS, 1.28%▲) has reported a net income of $325m, for Q2, or a diluted EPS of $3.79 ahead of last year’s $251.9m or an EPS of $2.95. Net revenue has increased by 17.1% y-o-y to $3.198bn. The stock soared by more than 6% after hours.

On the Lookout:

Apart from the two-day FOMC meeting of the Fed, to start today, the Consumer Confidence Index data is set to be released today, with a median forecast of 125 and a prior print of 127.3.

The S&P Case-Shiller Home Price Index, Housing Vacancies, and Durable Goods Orders data is due today as well.

Also, tech giants Apple, Microsoft, and Alphabet along with the Coffeehouse chain, Starbucks are set to release their Q2 earnings today.

Some IPOs to keep track:

The heart disease biotech, Tenaya Therapeutics, is offering 10m shares of its common stock priced between $14 and $16.

Smart Home integration company, Snap One Holdings, is set to raise $270m by offering 13.9m shares of its common stock, priced between $18 and $21, per share.

The media platform, Teads, is offering 38.5m shares of its common stock priced between $18 and $21, per share, targeting a $5bn market valuation.

The cell engineering platform, MaxCyte, is set to raise $150m by offering 12m shares of its common stock priced between $11.50 and $13.50, per share.

Unusually high shorter-term CALL options activity seen on CBS Corporation. (VIAC, 2.85%▲), Howmet Aerospace. (HWM, 0.40%▲), Tilray Inc. (TLRY, 0.81%▲), General Electric. (GE, 1.65%▲) and Riot Blockchain. (RIOT, 21.00%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Snap Inc. (SNAP, -2.12%▼), Confluent Inc (CFLT,-0.10%▼), Lordstown Motors. (RIDE, -2.54%▼), Six Flags Entertainment. (SIX, 5.42%▲) and Seaworld Entertainment (SEAS, 5.04%▲).

Other Asset Classes:

The 10 Year Treasury Yield and the 30 Year Treasury Yield, made gains late Monday afternoon, recovering from the falls earlier in the session. The former was 1.293% compared to Friday’s 1.285% while the latter rested at 1.941% ahead of Friday’s 1.924%. Tuesday morning though, there was another dip in the yields.

Crude Oil prices after the recent surge are exhibiting some volatility. The prices recovered late Monday after a substantial dip and fell again early Tuesday morning. Concerns regarding the delta variant’s potential of stifling economic recovery and an enhanced oil supply are making the prices go see-saw.

The US Dollar (92.76, 0.12%▲) recovered well, early Tuesday morning, after falling to a low of 92.56 on Monday. With the Fed meeting ahead the US dollar is expected to surge higher.

The CryptoCurrency, Bitcoin, shrugged off 4% of the gains Tuesday after breaching the $40,000 mark Monday for the first time since June 16, as Amazon refuted claims that it would accept BItcoin in payments.

Global Markets:

The Asian markets continued to plunge, for the third consecutive session, as a selloff in Chinese tech stocks, fuelled by the crackdown, continued. MSCI’s broadest index of Asia Pacific stocks outside Japan fell 0.25%, to its lowest level since mid-December. Shanghai fell more than 2% while Hang Seng slumped over 4%. Nikkei was an exception and surged more than 130 points.

The Chinese tech sector rout is weighing down the European Markets as well. EU markets opened lower Tuesday morning extending the gloomy Monday. Stoxx-600, down 0.56% in early trade. Besides, the government bond yields have fallen across the EuroZone, with Germany’s Bund holding close to a five and a half month low.

Meanwhile on Researchfin.ai

There are 27 new trade setups identified by the AI last Friday. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.