The Wealth of Nations!

Good Morning,

The energy provided by Energy! Norway’s $1.4tn Sovereign Wealth Fund, the world’s largest, has gained $111bn propelled by a 13.7% return from equities, the energy sector producing the maximum gain in Q2.

Chinese President, Xi Jinping, has called for “wealth redistribution” through “excessive” curbs on high income and encouraging the wealthy to give back more to society. Asian markets bounced back after Tuesday’s rout.

Taper and soon! Fed’s Boston President, Eric Rosengren, has said the massive bond-buying program was ill-suited for the US economy and will support tapering or even winding down the stimulus, as soon as next month. BTW, inflation in the UK slows more than expected to BOE’s target of 2%.

Move over! Tencent’s Q2 profit has risen 29% but the company has been replaced by Taiwan Semiconductor Manufacturing Company as Asia’s most valuable company with a market cap of $538bn.

Selling the disease and the cure! Marlboro maker Philip Morris has bought 22.61% of UK-based respiratory drug developer, Vectura, in a market purchase.

July Retail Sales, a closely watched gauge of economic health in the US, dropped by 1.1%, worse than the expected -0.3% and below the 0.7% growth in June.

Industrial Production, on the other hand, advanced 0.9% against the expected 0.4% and 0.2% in June.

US Markets:

All three major indices tumbled Tuesday in the wake of some weaker than expected economic data and concerns about rising delta variant cases.

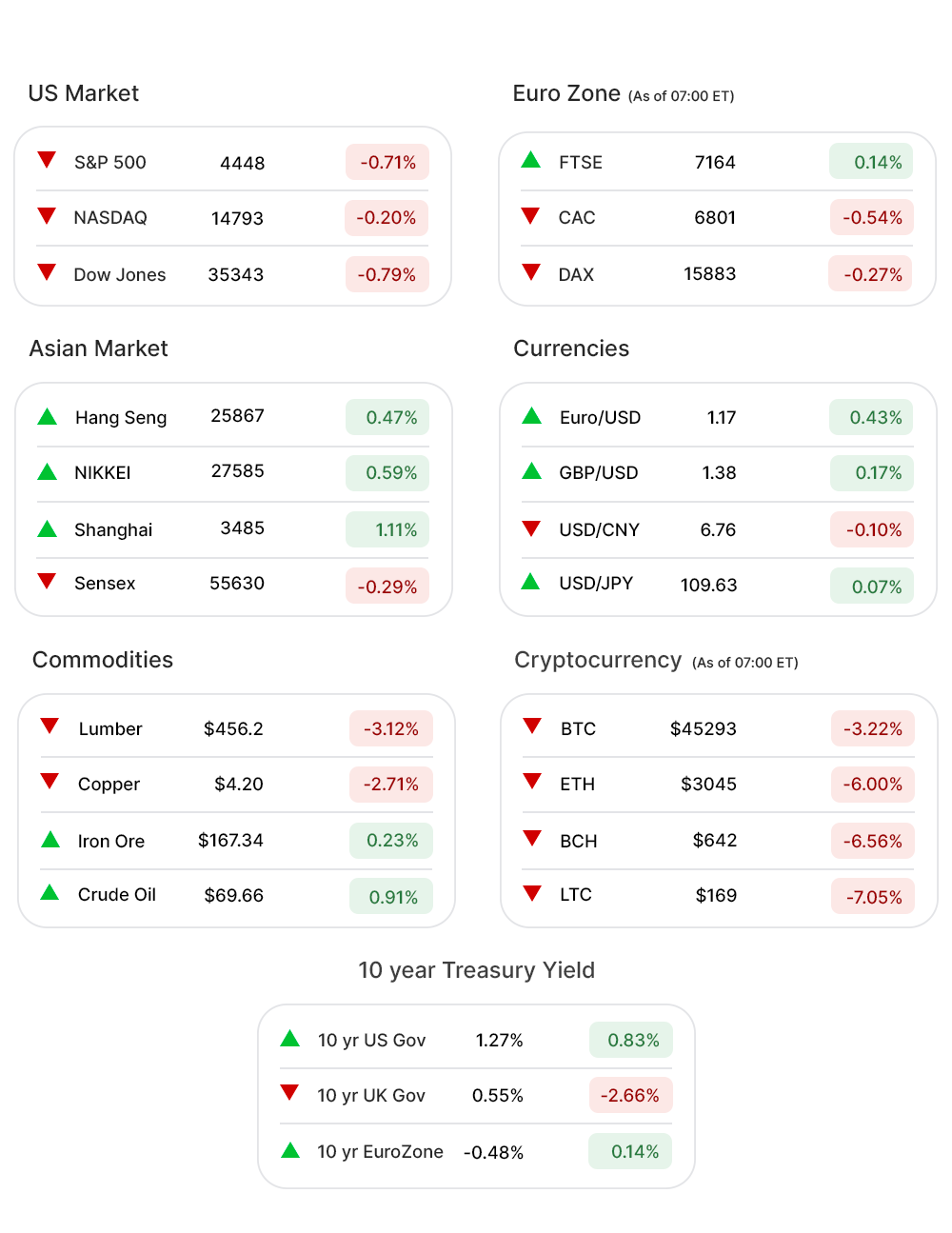

S&P 500 (-0.71%▼) lost more than 30 points to close at 4448. Dow Jones (-0.79%▼) and Nasdaq (-0.93%▼) lost 282 and 137 points, respectively.

At the S&P 500 red sectors outnumbered the green ones.

Consumer Discretionary (-2.31%▼), was the worst-hit sector, followed by Materials (-1.21%▼), Industrials (-1.06%▼), and Communication Services (-1.00%▼).

Energy (-0.92%▼) continued to slump for the third day in a row. was the sector with maximum losses, for the second day in a row, and so did Financials (-0.84%▼). Technology (-0.87%▼) was among the losers as well.

Healthcare (1.12%▲) continued the upward run, joined by Real Estate (0.15%▲), Consumer Staples (0.04%▲), and Utilities (0.02%▲) on Tuesday.

Futures!

The Futures slid lower, ahead of the Fed minutes, indicating another probable day of losses.

As of 06:00 ET, Futures were red without an exception: Russell 2000 Futures (-0.12%▼), Nasdaq Futures (-0.01%▼), S&P 500 Futures (-0.12%▼), and Dow Futures (-0.24%▼).

Key Movers in Small Cap:

HighPeak Energy Inc (HPK, -15.64%▼) announced the commencement of an underwritten public offering of 5m shares of its common stock. The relative volume of the stock was 10.8.

NI Holdings Inc (NODK, -0.83%▼) has announced that the company will repurchase approximately $5m of the company’s outstanding common stock. The relative volume of the stock was 6.3.

Gan Ltd (GAN, -16.28%▼) reported a 316% y-o-y jump in revenue to $34.6m but the loss of $2.7m or $0.07, per share, was wider than the expected loss of $0.01. The relative volume of the stock was 5.7.

CleanSpark Inc (CLSK, -15.15%▼) reported a 250% y-o-y increase in revenue to $11.9m but a net loss of $16.7m. The relative volume of the stock was 5.4.

Porch Group Inc (PRCH, -11.44%▼) tanked, despite reporting a 200% increase y-o-y in revenue and raising full-year guidance. The relative volume of the stock was 5.2.

The other movers in the small-cap segment included:

HealthEquity Inc. (HQY, -4.82%▼): Relative Volume 4.9.

Retractable Technologies Inc. (RVP, -12.63%▼): Relative Volume 4.7.

Sesen Bio Inc (SESN, 23.77%▲): Relative Volume 4.3.

Marlin Business Services. (MRLN, -0.05%▼): Relative Volume 4.1.

Forte Biosciences Inc. (MBII, -17.81%▼): Relative Volume 4.1.

Key Movers in Large Cap:

Home Depot Inc (HD, -4.27%▼) reported an 8.1% increase y-o-y in sales to $41.1bn, but fewer people shopped at the company’s store compared to the same quarter a year ago. The relative volume of the stock was 3.4.

CDK Global Inc. (CDK, -0.91%▼) came out with quarterly earnings of $0.66 per share, lower than the estimated $0.67, while the revenue of $420.1m missed the estimates by 1.77%. The relative volume of the stock was 3.0.

Lowe’s Companies Inc (LOW, -5.80%▼) beat consensus estimates on both EPS of $4.53 and revenue of 41.10bn but the customer transactions of the company were down 5.8% y-o-y.

The other movers in the large-cap segment included:

Liberty Media FormulaOne (FWONA, -1.11%▼): Relative Volume 3.2.

Invitation Homes Inc. (INVH, -0.05%▼): Relative Volume 2.9.

Lithia Motors Inc. (LAD, -9.69%▼): Relative Volume 2.8.

The Howard Hughes Corporation. (HHC, -0.87%▼): Relative Volume 2.6.

Report Card:

Walmart Inc (WMT, -0.033%▼) came out with an adjusted EPS of $1.78 on revenue of $141.05bn, easily beating the estimate of $1.57 on revenue of $137.17bn. The discounter also sharpened the forecast for the year and is anticipating earnings of $6.20 to $6.35. The stock slid a little after hours.

Agilent Technologies Inc (A, -0.67%▼) reported an EPS of $1.1 on revenue of $1.59bn, beating the estimates of $0.992 on revenue of $1.54bn. The stock climbed more than 1% after hours.

The e-commerce and gaming company, Sea Ltd(SE, 6.12%▲) reported a loss of $0.61 per share, wider than the expected $0.52, but the sales of $2.3bn handily beat the estimated $1.9bn. The stock slid by more than 1% after hours.

On the Lookout:

The minutes of Fed’s FOMC meet is due to be released today.

Important housing data, including Housing Starts and Building Permits, will be published today as well, with the former expected to grow from 1.59m to 1.61m and the latter expected to fall from 1.64m to 1.59m.

Unusually high shorter-term CALL options activity seen on Macy’s Inc (M, -3.38%▼), Occidental Petroleum (OXY, -2.86%▼), Coty Inc. (COTY, -2.11%▼), Freeport-McMoRan Inc (FCX, -5.78%▼), and Tattooed Chef Inc (TTCF, -2.67%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Ford Motor Company (F, -3.49%▼), GDS Holdings Ltd (GDS, -4.88%▼), Lowe’s Companies Inc (LOW, -5.80%▼), Akamai Technologies Inc (AKAM, -0.29%▼) and IHS Markit Limited. (INFO, -0.37%▼) among others.

Other Asset Classes:

The US Dollar (93.07, -0.06%▼) hovered near the 93 levels, attained Tuesday, ahead of the Fed minutes and some Housing stats due today.

US Treasury Yields rose Wednesday morning ahead of the data release, by the Fed. The 10 Year US Treasury Yield was trading in the red zone at 1.263%, much higher than Tuesday’s 1.227% mark.

Global Markets

After a day of losses inthe Asian Markets, amid fresh tech-sector regulations in China, the major markets of the region rebounded Wednesday registering some decent gains. Shanghai rose by 1.1%, Hang Seng advanced 121 points as Nikkei climbed 0.59%.

European markets had a robust start, Wednesday morning, with travel and defensive stocks keeping the indices buoyed, but as the day progressed the indices slid into the red zone.Stoxx-600 was flat at 0.0021% as FTSE, CAC, and DAX went red.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Head Hunter Group PLC. (HHR), Regeneron Pharmaceuticals Inc (REGN), Edwards Lifesciences Corp. (EW), Danaher Corporation (DHR), and Maravai Lifesciences Holdings (MRVI). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.