The ‘Zero Covid’ Squeeze!

Good Morning,

Taking no chances! China’s Ningbo-Zhoushan port, the third busiest port in the world, has been closed after one worker tested positive for Covid. The tightening supply networks will be further constricted.

Lord of The Rings abandons ‘Zero Covid’ New Zealand, as the country decides to keep travel restrictions intact till 2022. Amazon Studios relocates the production of the series to the UK.

Business over the environment! China’s expansion on Coal and Steel, this year, will emit 150m tonnes of CO2 equivalent to the total emissions of the Netherlands. This comes amidst extreme-weather catastrophes in the US and Europe dealing a $40bnblow to global insurers and a “code red” warning by the UN on climate change.

No child’s play! Bitcoin mining has gotten 7.3%more difficult to solve a block, and less profitable. The Bitcoin algorithm automatically resets the difficulty level for mining, every 2016 block or about every 2 weeks.

Adidas is selling Reebok to Authentic Brands Group for $2.5bn, a decade and a half after the German sports goods company acquired it for $3.8bn.

Producer Price Index has increased by 1%, more than expected, in July matching the June rise and dashing hopes that the upward rally of prices might begin to slow.

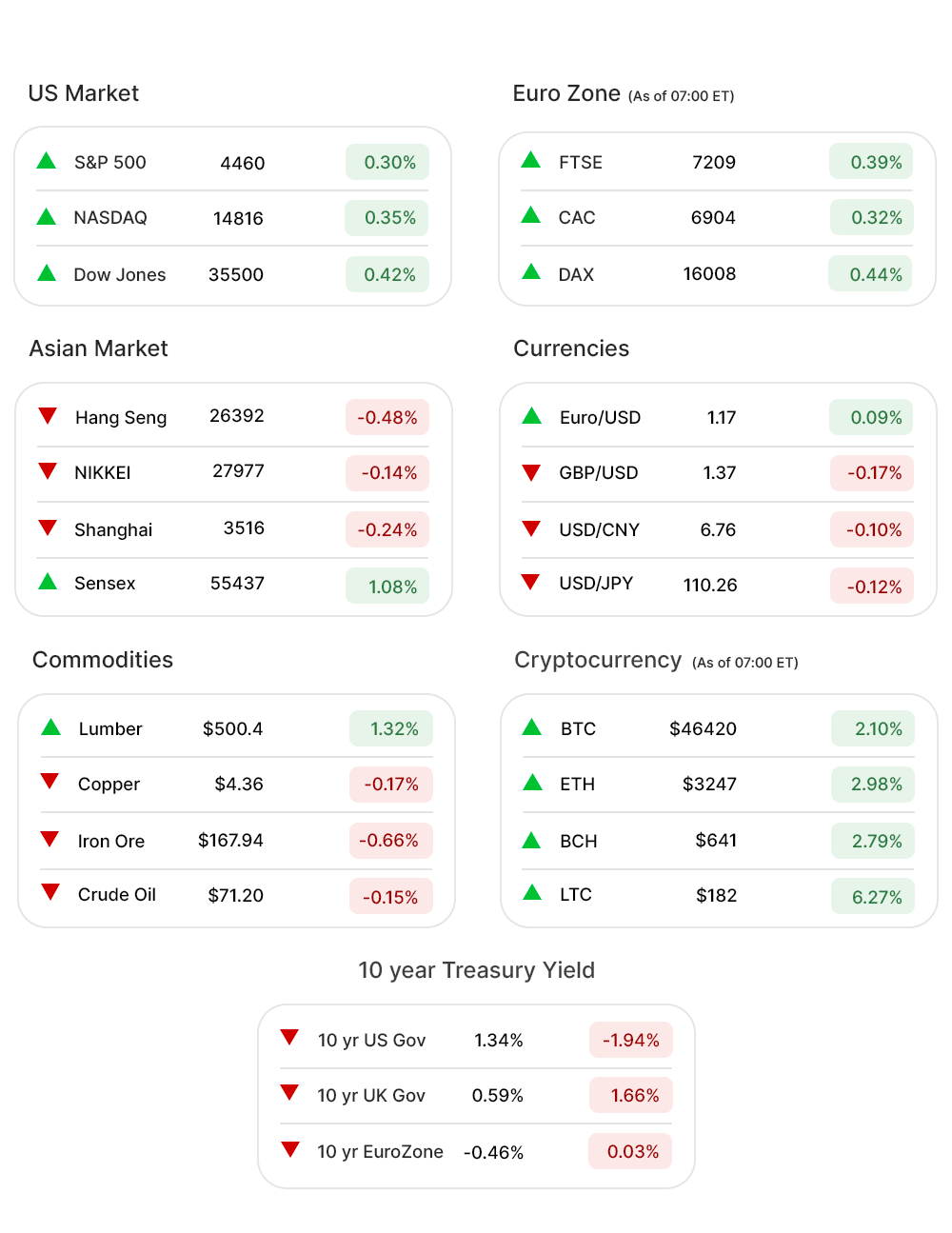

US Markets:

S&P 500 (0.30%▲) climbed more than 13 points to its 47th record high this year, as the stocks were fuelled by fresh labor market data, indicating Initial Jobless Claims fell to 375,000 from a revised 387,000.

Strong earnings reports further bolstered the rally pushing Dow Jones (0.04%▲) further up and tech-heavy Nasdaq (0.35%▲) into the green zone after a two-day rout.

Nasdaq was propelled by solid gains by tech giants, including Apple (AAPL, 2.08%▲), Facebook (FB, 0.75%▲), Amazon (AMZN, 0.35%▲), Alphabet (GOOGL, 0.67%▲), Microsoft (MSFT, 1.00%▲), and Nvidia (NVDA, 1.05%▲).

S&P 500 sectors were a mixed lot with four of them falling below the zero-mark and the rest making gains.

Healthcare (0.77%▲), Technology (0.59%▲), Real Estate (0.35%▲), and Communication Services (0.35%▲) were the top gaining sectors.

Energy (-0.49%▼), Industrials (-0.23%▼), Materials (-0.19%▼), and Consumer Staples (-0.08%▼) ended the day on the losing side.

Futures!

The Futures edged higher, Friday morning, as the stocks aim at closing the week in the green zone.

As of 07:00 ET, Russell 2000 Futures (-0.08%▼) was the only one in red. Nasdaq Futures (0.03%▲), S&P 500 Futures (0.07%▲), and Dow Futures (0.15%▲) were all green.

Key Movers in Small Cap:

ExOne Co(XONE, 45.14%▲), reported a loss of $0.25 per share, in sync with the estimates, and a revenue of $18.8m beating estimates. Besides, the company is merging with Desktop Metal. The relative volume of the stock was 28.8.

Medical products company, InfuSystem Holdings(INFU, -22.76%▼), came out with an EPS Of $0.04, missing the consensus of $0.11 and revenue of $24.83m missing the estimates by 9.70%. The relative volume of the stock was 15.1.

Farm supplies company, GrowGeneration Corp (GRWG, -17.07%▼), reported a three-fold increase y-o-y in its revenue to $125.9m but the EPS of $0.11 fell short of the estimated $0.12. Besides, the company said its sales will slow in the second half of the year. The relative volume of the stock was 12.1.

Chicken Soup for The Soul Entertainment(CSSE, -25.98%▼) reported a Q2 loss of $0.79 per share, more than the estimated $0.56 while the revenue of the company at $22.14m missed the estimates by 8.53%.The relative volume of the stock was 10.2.

Revolution Medicines Inc (RVMD, -10.97%▼) entered the oversold territory Thursday, hitting an RSI reading of 24.1. The relative volume of the stock was 6.5.

The other movers in the small-cap segment included:

Trean Insurance Group (TIG, -32.52%▼): Relative Volume 28.1.

Laird Superfood Inc. (LSF, -19.18%▼): Relative Volume 12.1.

Finch Therapeutics Inc (FNCH, 3.55%▲): Relative Volume 10.8.

Biglari Holdings Inc. (BH, -1.17%▼): Relative Volume 8.8.

Apyx Medical Corp. (APYX, 21.24%▲): Relative Volume 6.4.

Key Movers in Large Cap:

GoHealth Inc (GOCO, -42.80%▼), reported a Q2 loss of 12 cents per share, falling below the estimated 4 cents per share. The revenue of $196.9m beat the estimates of $175.08m comprehensively. The relative volume of the stock was 26.2.

Gates Industrial Corporation (GTES, -0.72%▼) fell for the second day Thursday after it announced a secondary offering of 25m shares of its common stock. The relative volume of the stock was 13.0.

The software company, Palantir Technologies Inc (PLTR, 11.36%▲), reported a 49% y-o-y increase in revenue, for Q2, to $375.6m, way ahead of the estimated $360.3m. The earnings per share of 4 cents were well in tune with the expectations. The relative volume of the stock was 9.2.

The home buying and selling company, Opendoor Technologies (OPEN, 24.00%▲) reported that the company sold 3481 houses in Q2, up 41% compared to the first quarter. The revenue of the company jumped 59% sequentially to $1.2bn. The relative volume of the stock was 8.7.

The e-commerce platform for buying and selling used cars, Vroom Inc (VRM, -19.97%▼), reported a 588% y-o-y increase in e-commerce gross profit. The units sold through the platform in the quarter were 18268, 172% up y-o-y. The relative volume of the stock was 6.4.

The other movers in the large-cap segment included:

Aspen Technology Inc. (AZPN, -11.79%▼): Relative Volume 5.5.

Organon & Co. (OGN, 11.93%▲): Relative Volume 4.0.

Micron Technology Inc (MU, -6.37%▼): Relative Volume 3.3.

The AZEK Company Inc (AZEK, 8.67%▲): Relative Volume 3.2.

Report Card:

With a strong rebound of visitors to its parks, Walt Disney Co (DIS, 0.67%▲), reported Q3 sales of $17bn, up 45% y-o-y. The profit of $918m or 50 cents a share is a major improvement from the prior year’s loss of $2.61 a share or $4.72bn. The stock climbed more than 5% after hours.

The online marketplace for lodging, Airbnb Inc (ABNB, 2.02%▲), reported a 300% y-o-y increase in revenue to $1.34bn and a loss of 11 cents per share. The company however warned investors about unexpected volatility in wake of the Covid delta variant. The stock fell by more than 5% after hours.

The food delivery platform DoorDash Inc (DASH, -1.23%▼) reported an 83% y-o-y increase in revenue to $1.24bn but the company also reported a net loss for the quarter, of $102m wider than the expected $74.6m. The stock further plunged, by more than 5%, after hours.

The producer of packaged bakery food, Flowers Foods Inc (FLO, -0.65%▼), reported a 0.8% decrease y-o-y in sales to $1.01bn and a decrease of $0.01 in adjusted, diluted EPS y-o-y to $0.32. The stock, however, soared more than 3% after hours.

On the Lookout:

The Import Price Index for the month of July is due today and the print is expected to drop from 1%, in June, to 0.6%.

The UMich Consumer Sentiment Index (early) is expected to rise by 1 basis point, from 81.2 to 81.3.

A couple of IPOs for today:

CENAQ Energy Corporation is planning to raise around $150m by offering 15m shares of its common stock, at a price of $10 per share.

Dermata Therapeutics will raise $18m by offering 1.8m ordinary shares, priced between $7 and $9.

Unusually high shorter-term CALL options activity seen on Foot Locker Inc (FL, -1.39%▼), Groupon Inc (GRPN, -2.71%▼), Allot Ltd. (ALLT, -2.43%▼), International Game Technology (IGT, 0.80%▲), and Lightning EMotors Inc (CNI, -12.78%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Analog Devices Inc. (ADI, -1.10%▼), Melco Resorts and Entertainment (MLCO, -2.59%▼), Penn National Gaming Inc (PENN,2.45%▲), Apple Inc. (AAPL, 2.08%▲), and PagSeguro Digital (PAGS,-1.77%▼) among others.

Other Asset Classes:

Crude Oil prices were again into the red zone, early Friday morning, extending losses incurred on Thursday following a call by White House on Opec seeking a boost to output and terming the present output “not enough”. Brent was down to the $71 per barrel mark with a loss of 0.43% while the WTI Crude traded down 0.62%.

The US Dollar (92.99, -0.05%▼) remained flat, hovering close to the 93 mark as economic data is pointing towards a steady recovery in the US. The softness in the greenback, however, might not be long-lasting as the Fed intends to taper stimulus sooner than expected.

US Treasury Yields continued to slide for the second day in a row, as inflation rose less than expected and the Jobless Claims fell well within the ambit of what was expected. The 10 Year US Treasury Yield was trading in the red zone at 1.34%, early Friday morning.

Global Markets

The Asian Markets were mostly down as investors have their eyes fixed on a bunch of economic data, next week, coming in from Japan, China, and Thailand. Besides, the widening crackdown on strategic economic sectors inChina also weighed the markets down. Shanghai fell by 0.24% while Hang Seng lost in excess of 190 points by the close. Nikkei was down 0.14%.

European markets looked all set to close the week in the green zone, buoyed by Thursday’s rally in the US markets and retail stocks inching up by 0.6%, early Friday morning. Pan EU index Stoxx-600 was up 0.08%, while FTSE reached an 18 month high with modest gains even as CAC, and DAX was in the green zone as well.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Goosehead Insurance Inc. (DDS), Tejon Ranch Company (PLCE), and Evoqua Water Technologies (RTP). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Enjoy the weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.