Tough Ending to Q3!

Good Morning!

We’re taking a break! Well, only from publishing this newsletter, ‘Opening Bell’. We know that the newsletter has become a part of you for a while now, and we would like to continue to keep it so. We are working on a makeover to bring more value to each of you reading our content. In the meantime, do let us know any suggestions/feedback of what you'd like from us at social@researchfin.ai.

The wonder pill! Merck would ask US regulators to authorize the first antiviral pill to treat Covid-19 after a late-stage clinical trial showed the drug cut the risk of hospitalization or death in half. If the US Food and Drug Administration authorizes the drug, called molnupiravir, it would be the first treatment of its kind — a twice-daily pill prescribed for five days to patients who have recently been diagnosed with Covid.

Oyo, the SoftBank-backed hotel platform, has filed for an initial public offering to raise $1.1bn, the latest in a flurry of lossmaking Indian start-ups trying to tap the country’s red-hot equity markets. The company, which is almost 47 per cent-owned by SoftBank, was one of the Japanese group’s biggest bets in India’s tech market, burning investor cash as it expanded rapidly in a quest to become the world’s largest hotel chain.

Reviewing Thursday's economic data:

Initial jobless claims for the week ending September 25 increased by 11k to 362k. Continuing claims for the week ending September 18 decreased by 18k to 2.802 million. The key takeaway from the report is the surprisingly high number of initial jobless claims when job openings are at a record high and confidence is building that the dampening effects of the Delta variant are lifting.

The third estimate for Q2 GDP checked in at 6.7% versus the second estimate of 6.6%. The GDP Deflator was unchanged at 6.1%. The key takeaway from the report is that its dated nature (released on the last day of the third quarter), and the lack of any meaningful change from the second estimate, have robbed it of any market-moving influence.

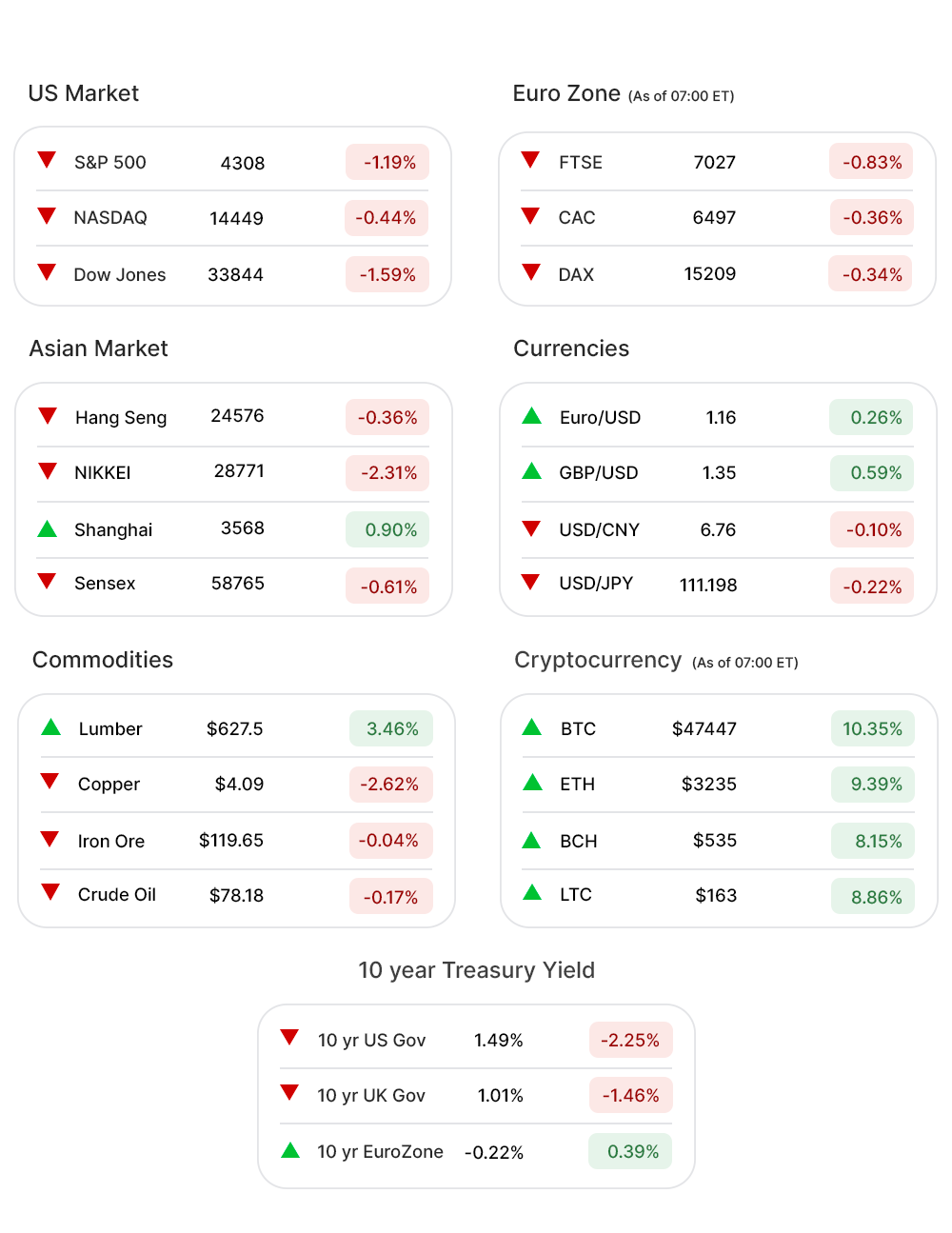

US Markets:

The S&P 500 fell 1.2% on Thursday and closed at session lows in a volatile session to end the third quarter. The Dow Jones Industrial Average declined 1.6%, the Russell 2000 declined 0.9%, and the Nasdaq Composite declined just 0.4%.

The broader market struggled as investors had to contend with some softening economic data, disappointing earnings news, continued uncertainty on infrastructure, and even some quarter-end machinations.

All 11 S&P 500 sectors closed lower, as selling interest accelerated into the close on no specific news. The industrials sector (-2.1%) led the retreat with a 2% decline while the communication services sector (-0.4%) outperformed on a relative basis with a 0.4% decline.

Futures!

Futures markets signaled that Wall Street’s S&P 500, which ended September almost 5 per cent lower in its worst performance since the coronavirus-induced rout of March 2020, would lose 0.5 per cent in early New York dealings.

Key Movers in Small Cap:

Bed Bath & Beyond Inc. (BBBY, -22.18%▼)The home-goods retailer lost more than a fifth of its market value Thursday after reporting a sharp drop in quarterly sales, citing supply-chain challenges, inflation, and people avoiding stores due to Covid-19 concerns. The relative volume of the stock was 13.8.

OptimizeRx Corporation (OPRX, 14.13%▲) gained 15% to $86.18. OptimizeRx is set to join S&P SmallCap 600, effective Monday, October 4th. On September 30, 2021, OptimizeRx Corporation announced that Edward Stelmakh has been appointed to serve as the Company's Chief Financial Officer/Chief Operations Officer, effective as of October 11, 2021. The relative volume of the stock was 7.5.

The other movers in the small-cap segment included:

Aemetis Inc (AMTX, 12.01%▲): Relative Volume 5.9.

Catalyst Pharmaceuticals Inc (CPRX, 5.58%▲): Relative Volume 4.3.

Key Movers in Large Cap:

CarMax Inc (KMX, 12.63%▼) The auto retailer missed estimates by 18 cents with quarterly earnings of $1.72 per share, although revenue topped analyst projections. Comparable pre-owned car sales rose 6.2%, less than the 7.3% estimate of analysts. The relative volume of the stock was 4.6.

Hanesbrands Inc. (HBI, 7.34%▼) slipped to $17.16 Thursday, on what proved to be an all-around grim trading session for the stock market, The stock underperformed when compared to some of its competitors Thursday, as Ralph Lauren Corp. Cl A (RL, -5.00%▼), PVH Corp. (PVH, -6.02%▼), and Gildan Activewear Inc. (GIL, -2.14%▼). The relative volume of the stock was 2.5.

The other movers in the large-cap segment included:

Altria Group Inc (MO, -6.61%▼): Relative Volume 2.7.

Paychex, Inc. (PAYX, -1.09%▼): Relative Volume 2.1.

Dollar Tree, Inc. (DLTR, -4.77%▼): Relative Volume 2.0.

Report Card:

Bed Bath & Beyond (BBBY, -22.1%▼) provided terrible earnings results and guidance. BBBY shares dropped 22%. CarMax (KMX, -12.6%▼) missed EPS estimates, and McCormick (MKC, -3.2%▼) trimmed its FY21 EPS guidance due to ongoing supply chain issues.

On the Lookout:

Looking ahead to Friday, investors will receive the ISM Manufacturing Index for September, Personal Income and Spending for August, PCE Prices for August, the final Univ. of Michigan Index of Consumer Sentiment for September, Construction Spending for August, and the final Markit Manufacturing PMI for September.

Unusually high shorter-term CALL options activity seen on Bed Bath & Beyond Inc. (BBBY, -22.18%▼), BP plc (BP, -1.62%▼), Acceleron Pharma (XLRN, -1.86%▼), Corteva Inc (CTVA, -1.82%▼), and Beyond Meat Inc (BYND, -1.00%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Cisco ICICI Bank Ltd (IBN, -1.77%▼), Turtle Beach Corp (HEAR, 0.43%▲), Royal Caribbean Cruises Ltd (RCL, -1.90%▼), Analog Devices (ADI, -0.81%▼) and Tesla (TSLA, -0.75%▼) among others.

Other Asset Classes:

The yield on the 10-year US Treasury bond fell 0.05 percentage points to 1.481 per cent as investors selling equities sought shelter in the low-risk asset, despite half of Fed officials last week forecasting an interest rate risk next year.

Brent crude, the international oil benchmark, inched 0.2 per cent lower to $78.14 a barrel after touching $80 earlier this week for the first time in almost three years.

The dollar index, which tracks the US currency against six others including the euro and sterling, was steady after touching a one-year high in the previous session.

Global Markets:

European equities started the third quarter of the year lower, as concerns about economic stagflation and US monetary policy combined with surging energy prices and risks of a slowdown in China’s industrial and property sectors to prolong a downturn in global stock markets. The regional Stoxx 600 index, which rallied to a record in early September before losing 3.4 per cent over the month, dropped 0.9 per cent in early trading. London’s FTSE 100 fell 0.7 per cent.

In Asia, Tokyo’s Topix share index dropped 2.2 per cent. Markets in Hong Kong and mainland China were closed on Friday for a holiday.

Meanwhile on Researchfin.ai

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

See you when we see you!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.