Un-levered Bets!

Good morning!

US investors are cutting back on leverage, for the first time since the pandemic began, as they remove some of the borrowed money. In July investors borrowed $844bn, down from $882bn the prior month and the lowest since March.

The tech vows! Leading US tech companies have pledged to invest billions of dollars to strengthen CyberSecurity defenses and train skilled workers - at a White House summit. Microsoft will spend $20bn over the next 5 years while IBM plans to train 150,000 people in CyberSecurity over three years.

Not upbeat! The print on Germany’s Consumer Sentiment Index dropped to -1.2 points for September, lower than August’s -0.4 and the forecast of -0.7. EU stocks dropped.

Interest-ing! South Korea becomes the first major Asian economy to raise interest rates since the beginning of the pandemic, from a record low of 0.5% to 0.75%. The move is aimed at curbing household debt and soaring home prices. KOSPI slid 0.58%.

Grande, no more! $80bn or 92% of China Evergrande New Energy Vehicle Group’s share value has been wiped off since April. The stock plummeted 22% Thursday after reporting a loss of $470m in the first half.

As the supplies remain constricted, the US Durable Goods Orders have declined by 0.1% to a seasonally adjusted $257.2bn in July, as compared to a rise of 0.8% in June. The orders were expected to fall by 0.5%.

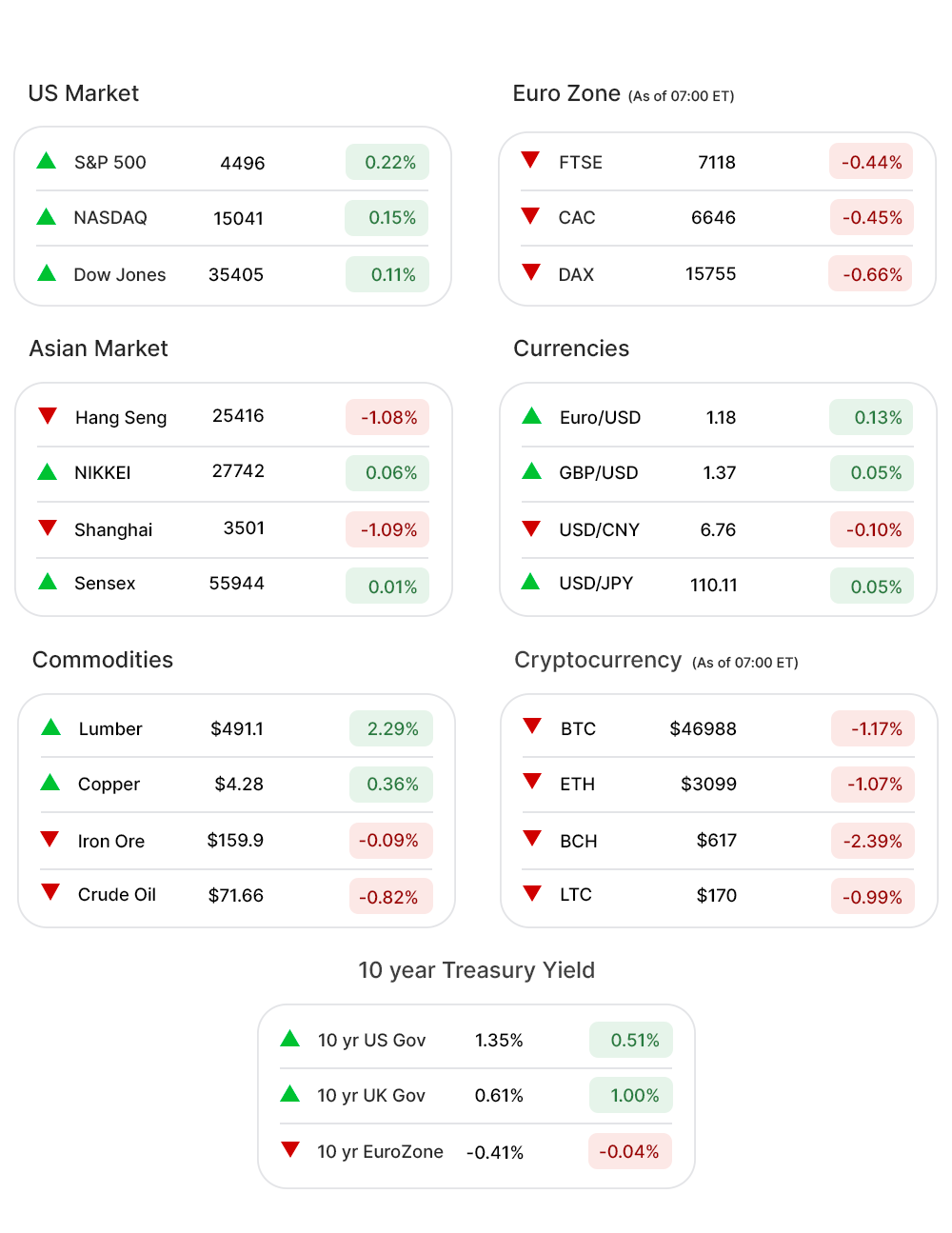

US Markets:

The positivity in the markets continued for the third day in a row, buoyed by the FDA approval to the Covid vaccine and a Congress nod to the $1tr infrastructure bill.

Shares of banks and economically sensitive companies led the major indices higher with the S&P 500 (0.2%▲) gaining more than 9 points, while it notched the 51st record close of the year, tenth this month.

Nasdaq (0.1%▲) rose 22 points and hit a record close, as well. Dow Jones (0.1%▲) gained over 39 points, while Russel 2000 (0.37%▲) climbed some 8 odd points.

Sectors at the S&P 500 were mixed with Healthcare (-0.26%▼), Consumer Staples (-0.10%▼), Real Estate (-0.18%▼), Technology (-0.06%▼), slumping for the second consecutive day.

Utilities (0.21%▲), after Tuesday’s slump, joined Energy (0.72%▲), Consumer Discretionary (0.31%▲), Communication Services (0.22%▲), Financials (1.21%▲), Industrials (0.60%▲), and Materials (0.42%▲) to make gains.

Futures!

Futures were mixed ahead of the opening on Thursday as Fed’s Jackson Hole symposium on Friday continues to be the talked-about subject among the investors.

As of 06:30 ET, Dow Futures (0.01%▲) was the only green index. Russell 2000 Futures (-0.17%▼), Nasdaq Futures (-0.20%▼), and S&P 500 Futures (-0.09%▼) were all red.

Key Movers in Small Cap:

Trustmark Corp (TRMK, 8.69%▲) has entered into a strategic alliance with Commonwealth National Bank, to amplify economic opportunities in minority and underserved communities. The relative volume of the stock was 14.1.

BioLife Solutions (BLFS, 19.62%▲) Wednesday announced that its stock will be added to S&P SmallCap 600, effective prior to the opening of trading on Monday, August 30. The relative volume of the stock was 11.7.

ScanSource Inc (SCSC, 15.29%▲) was fuelled by the release of a strong fourth-quarter earnings report. The relative volume of the stock was 10.8.

Option Care Health Inc (OPCH, 6.87%▲) was Wednesday added to the S&P MidCap 400 index. The relative volume of the stock was 8.7.

The FDA has received a citizen petition against Simufilam, the Alzheimer’s disease candidate of Cassava Sciences Inc (SAVA, -31.38%▼). The relative volume of the stock was 6.7.

The other movers in the small-cap segment included:

Mimecast Ltd. (MIME, 7.90%▲): Relative Volume 9.2.

Saia Inc. (SAIA, -5.21%▼): Relative Volume 5.4.

Southern First Bancshares. (SFST, 1.57%▲): Relative Volume 4.6.

Hall of Fame Resort & Entertainment. (HOFV, 8.72%▲): Relative Volume 4.6.

Key Movers in Large Cap:

DIck’s Sporting Goods (DKS, 13.30%▲) delivered excellent second-quarter results and increased its cash payout to shareholders. The relative volume of the stock was 11.0.

Nordstorm Inc (JWN, -17.64%▼) came out with better than expected Q2 results on Tuesday, but investors focussed on the company’s performance compared to pre-pandemic results. The relative volume of the stock was 8.4

BIO-TECHNE Corp (TECH, 1.57%▲) will join the broadest US index S&P 500, on August 30. The relative volume of the stock was 5.2.

Media reports suggested that Western Digital Corp (WDC, 7.80%▲) might merge with Japan’s Kioxia Holdings, in a $20bn deal. The relative volume of the stock was 3.6.

The other movers in the large-cap segment included:

GameStop Corp (GME, -5.06%▼): Relative Volume 4.8.

Maxim Integrated Products. (MXIM, -1.18%▼): Relative Volume 3.9.

Analog Devices Inc. (ADI, -1.12%▼): Relative Volume 3.5.

The Boston Beer Company. (SAM, -3.53%▼): Relative Volume 3.3.

Report Card:

ScanSource Inc (SCSC, 15.29%▲) reported a 34% y-o-y increase in revenue to $852.7m, while the net income (GAAP) has come in at $23.3m. The company has also announced a $100m buy-back program. The stock remained flat after hours.

Dick’s Sporting Goods (DKS, 13.30%▲) reported a 20.07% y-o-y in net sales to $3.27bn, fulled by a 19.2% increase in same-store sales. The adjusted net income soared 77% y-o-y to $501.2m or $5.08 per share.

The revenue of software company Autodesk Inc (ADSK, 0.35%▲), increased 16% y-o-y to $1060m, while the GAAP diluted EPS came out to be $0.52. The stock slid around 7% after hours.

Cloud-based software company Salesforce.com Inc (CRM, 0.46%▲) reported a revenue of over $6bn for the first time. For Q2 the revenue of $6.34bn is up 23% y-o-y. The EPS came in at $1.48, ahead of the estimated 92 cents per share. The stock climbed more than 1% after hours.

On the Lookout:

Initial Jobless Claims are expected to come out at 350,000, a wee bit more than last week’s 348,000. The Continuous Jobless Claims have a previous print of 2.82m.

GDP revision (SAAR) is due today as well and is expected to climb from 6.5% to 6.7%.

Unusually high shorter-term CALL options activity seen on Southwest Airlines Co (LUV, 0.87%▲), Gap Inc (GPS, -5.31%▼), Analog Devices Inc. (ADI, -1.12%▼), Penn National Gaming (PENN, 8.66%▲), and Aecom (ACM, 2.53%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on American Eagle Outfitters (AEO, -6.12%▼), Riot Blockchain (RIOT, 0.24%▲), Chevron Corporation (CVX, 0.68%▲), Guess? Inc (GES, -1.23%▼), and Autodesk Inc. (ADSK, 0.35%▲) among others.

Other Asset Classes:

Crude Oil Prices - have remained steady since the losing streak last week, and despite the small losses incurred early Thursday morning. Brent was 0.65% down but traded well above the $71 per barrel mark.

The US Dollar (92.88, 0.06%▲) slid below the 93-mark on Wednesday but could be seen making some gains this morning.

The US Treasury Yields pulled back a little early Thursday morning, after making decent gains Wednesday afternoon. The 10 Year US Treasury Yield was trading at the 1.347% mark, early Thursday morning.

Global Markets:

Disappointing financial results by Tiktiok rival Kuaishou pulled the stock down 12%, dragging other major tech stocks along, and impacting markets in the Asia Pacific negatively. Shanghai fell by more than 1%, and Hang Seng by 1.47%. Nikkei made some last-hour gains after trading in red through the day and closed 0.06% higher. Hang Seng’s tech index was down more than 2%.

Travel stocks in European markets tumbled Thursday morning with German Consumer Morale darkening. Major indices, including Stoxx-600, DAX, FTSE, and CAC traded in the red zone.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Carrier Global Corp. (CARR), Blackstone Inc (BX), Dynatrace Inc. (DT), Option Care Health Inc (OPCH), Dick’s Sporting Goods (DKS), Mimecast Ltd (MIME), MaxLinear Inc. (MXL), DEXUS Property Group (DKS), and Wolverine Worldeide Inc (WWW). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you Friday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.