Vanishing Passengers!

Good Morning!

Fewer rides! China’s ride-hailing giant DiDi Global has lost 30% of its daily users, since its New York IPO in June this year, as mainland regulators banned the company from registering new users in wake of an ongoing data security investigation. After the initial flight, the DiDi stock is down 41% since its debut in the US.

Shopping spree amid Covid! In Southeast Asia, the number of online shoppers has increased by 70m, since the beginning of the pandemic. The total number is expected to reach 380m by 2026.

Not buying dips anymore! Retail investors bought between 35% to 100% more in July and August than they did in similar-sized dips between September 10 and 14. Why are investors abandoning a tried and tested buy-the-dip strategy?

With the easing of inflationary pressure, the US Import Price Index has fallen for the first time in 10 months, to -0.3 for August, while it was expected to remain unchanged at July’s 0.3%.

Back to basics! The US Industrial Production, for the month of August, has returned to the pre-pandemic levels at 0.4%, lower than the expected 0.5%. The print could have been 0.3% higher, had the hurricane, Ida, not struck and caused floods in parts of the country.

The Empire State Index, a summary of general business conditions in New York state, for the month of September was expected to slide from 18.3 to 17.2 but soared to a mammoth 34.3 instead.

Woman power! Australian graphic design business Canva has become the world’s most valuable women-founded and women-led startup - valued at $40bn after a fresh $200 round of private equity investment. Canva is now the fifth-most valuable privately owned startup in the world.

Tennis star, Roger Federer-backed Swiss running shoemaker On Holding AG has soared 46% on its first day of trading in New York. The stock closed at $35, Wednesday, after being sold at $24 per share.

Crypto’s Laos haven! The Southeast Asian country has approved Crypto mining and trading, amid concerns that the move might benefit criminal organizations.

US Markets:

After an initial wobble, pertaining to weak economic data from China, the stocks pushed higher by the close shrugging off Tuesday’s losses, with major indices closing in the green zone.

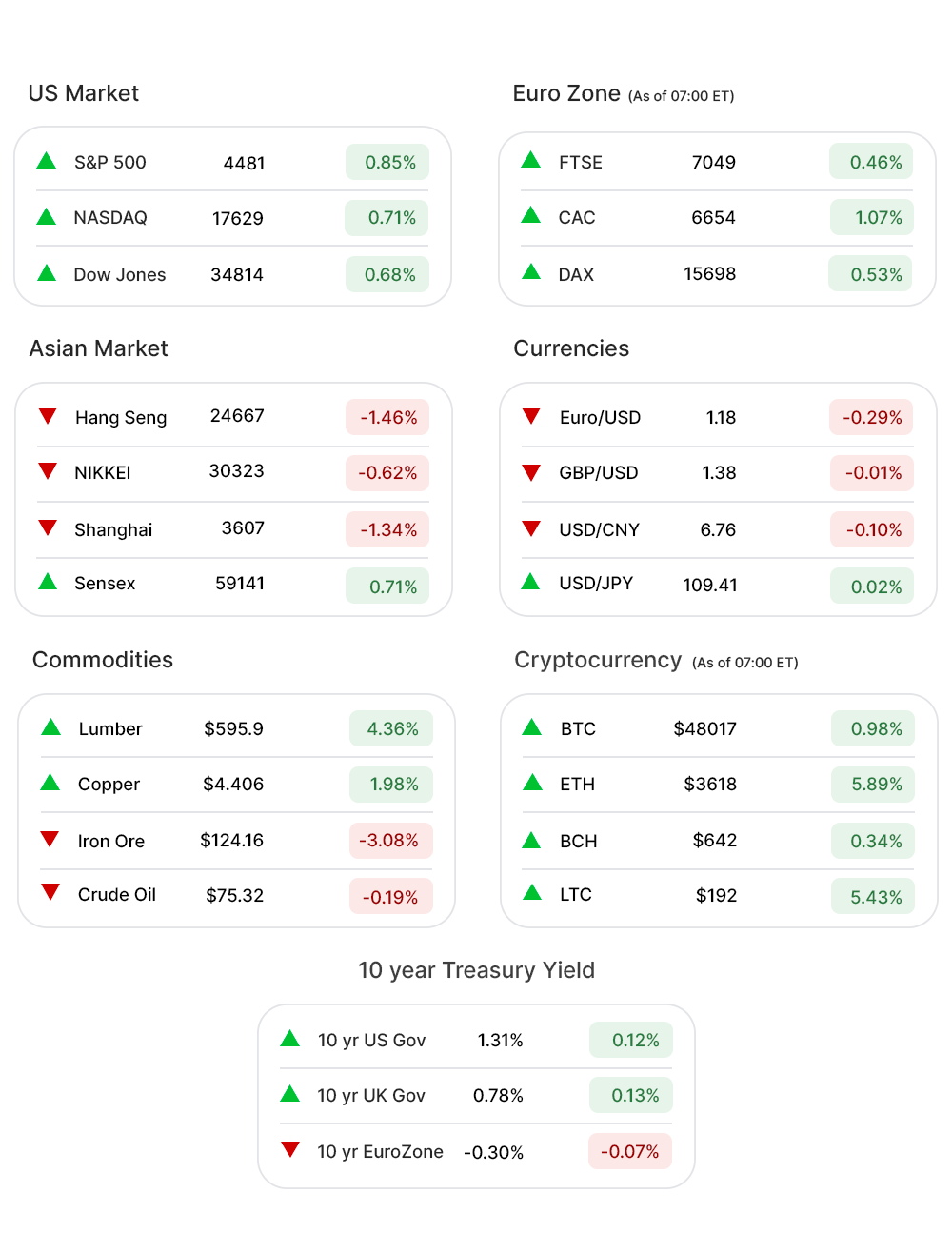

S&P 500 (0.85%▲) snapped the six-day streak of closing below its opening level with a gain of more than 37 points and recorded its best day in more than two weeks. Dow Jones (0.68%▲) gained 282 points, following a 300 point slide on Tuesday, while Russel 2000 (1.11%▲) advanced by around 25 points.

Tech-heavy Nasdaq (0.78%▲) was buoyed as well and managed to gain over 120 points by the close Wednesday.

Utilities (-0.56%▼) was the only red sector at the S&P 500, while the other ten sectors secured decent gains.

Energy (3.82%▲) cashed in on a rally in oil prices and was the major factor leading S&P 500 higher for the day. Industrials (1.12%▲), Materials (1.10%▲) were up with some substantial gains as well.

Financials (0.93%▲), Communication Services (0.72%▲), Consumer Discretionary (0.66%▲), Consumer Staples (0.40%▲), Technology (0.89%▲), Real Estate (0.41%▲), and Healthcare (0.68%▲) managed to secure some gains by the close.

Futures!

The US stock futures, after Wednesday’s rally, were in red this morning.

As of 07:00 ET, none of the indices was in green. Nasdaq Futures (-0.23%▼), Dow Futures (-0.10%▼), S&P 500 Futures (-0.16%▼), and Russel 2000 Futures (-0.%▼).

Key Movers in Small Cap:

The Goldman Sachs Group is buying specialty lender GreenSky LLC (GSKY, 53.64%▲) for $2.2bn, in a bid to expand into main street banking. The relative volume of the stock was 15.8.

Theravance Biopharma Inc (TBPH, -15.80%▼) Wednesday announced disappointing results from its phase-3 study of Ampreloxetine, a drug aimed at treating symptomatic neurogenic orthostatic hypotension. The relative volume of the stock was 11.8.

An institutional short-seller Wednesday accused Berkeley Lights (BLI, -18.74%▼) of “fleecing customers and IPO bagholders with a $2m Black Box, that’s a clunker,”. The relative volume of the stock was 11.0.

PAR Technology Corporation (PAR, 10.16%▲) Wednesday announced the pricing of its offering of stocks and convertible notes. The relative volume of the stock was 8.6.

The other movers in the small-cap segment included:

ChromaDax Corporation (CDXC, -4.17%▼): Relative Volume 18.7.

CrossFirst Bancshares Inc (CFB, 2.10%▲): Relative Volume 12.4.

Reliant Bancorp Inc (RBNC, 2.50%▲): Relative Volume 12.1.

Ibex Limited (IBEX, -0.53%▼): Relative Volume 10.1.

APi Group Corporation (APG, 0.19%▲): Relative Volume 8.8.

Key Movers in Large Cap:

The regulatory headwinds casino operators in Macau will be facing made Wynn Resorts (WYNN, -6.30%▼)tumble again for half of the company’s operating revenue come from 2 casinos it operates out there. The relative volume of the stock was 4.6.

The other movers in the large-cap segment included:

Leslie’s Inc (LESL, 1.03%▲): Relative Volume 6.8.

Jamf Corporation (JAMF, 6.13%▲): Relative Volume 4.7.

Advanced Drainage Systems (WMS, -6.23%▼): Relative Volume 4.1.

Royalty Pharma Plc (RPRX, -4.29%▼): Relative Volume 3.6.

Paylocity Holding Corp (PCTY, 2.32%▲): Relative Volume 2.7.

Live Nation Entertainment (LYV, -2.40%▼): Relative Volume 2.6.

Report Card:

JinkoSolar Holding (JKS, 4.13%▲) reported a 6.2% y-o-y drop in revenue to $1.23bn, while the gross profit decreased 10.2% y-o-y to $210.5m. The stock continued to be in the green zone after hours.

The Bitcoin mining supplier Canaan Inc (CAN, -10.57%▼) reported a 507.3% y-o-y increase in revenue to $167.5m, while the net come came out at $37.9m or $1.45 per share. The stock climbed by half a percent after hours.

On the Lookout:

Initial Jobless Claims (regular state program), for the week ended September 11, is expected to come in at 381,000 considerably higher than the last week’s 310,000.

Continuing Jobless Claims (regular state program) is due today as well, with a previous print of 2.78m.

Retail Sales for the month of August are expected to increase, from July’s -1.1% to -0.7%, and so are the Retail Sales ex-autos, which are expected to climb from July’s -0.4% to 0.2%.

Philadelphia Fed Manufacturing Survey, for the month of September, is expected to go down from the previous print of 19.4 to 18.9. And the Business Inventories for the month of August are expected to decrease from 0.8% to 0.5%.

Unusually high shorter-term CALL options activity seen on Zynga Inc (ZNGA, -1.71%▼), Affirm Holdings Inc (AFRM, 1.56%▲), International Game Technology (IGT, 3.26%▲), Uber Technologies (UBER, -1.36%▼), and the United States Steel Co (X, 4.99%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Wynn Resorts (WYNN, -6.30%▼), Walmart Inc (WMT, 0.17%▲), Altimmune Inc (ALT, -0.48%▼), Las Vegas Sands (LVS, -1.70%▼), and Yeti Holdings Inc (YETI, 1.77%▲) among others.

Other Asset Classes:

Crude Oil Prices - An unexpected 6.4m barrel drawdown in US Crude inventories and China’s daily oil refinery output hitting a 15-month low sent Crude Oil prices soaring higher with Brent Crude breaching the $75 per barrel mark. Early Thursday morning Brent held the position even as WTI Crude traded well ahead of the $72 per barrel mark.

The US Dollar Index (92.7, 0.17%▲) hovered near the middle of its range in the past month as focus shifts on potential clues from the Fed on stimulus tapering, as well as the soaring crude oil prices.

The US Treasury Yields climbed slightly higher, ahead of the weekly Jobless data, early Thursday morning. The 10 Year US Treasury Yield was trading, slightly into the green zone, at 1.307%, considerably ahead of Wednesday’s 1.28%.

Global Markets:

The Asian Markets, despite a bounceback in the US on Wednesday, traded mostly lower Thursday as weak economic data from China, the government’s tightening grip on businesses in the mainland, and the rising cost of fuel weighed down the investor sentiment. Hang Seng, fell by about a little less than 400 points or 1.59%. Shanghai and Tokyo's Nikkei were down 1.34% and 0.62% respectively.

The overnight strength in the Wallstreet, however, buoyed the European markets, which were further boosted by a rebound in travel stocks at the opening on Thursday. Soon after the opening all major indices, including FTSE (0.48%), CAC (0.66%), DAX (0.64%) and the pan-EU index Stoxx-600 (0.64%) were trading higher.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Workiva Inc (WK), Alcon AG (ALC), Allegro MicroSystems Inc (ALGM), Cabot Oil & Gas Corporation (COG) and DigitalOcean Holdings Inc. (DOCN). Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you Friday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.