Viva Europa!

Good Morning,

Our App is live! Hope you are making the most of the trading opportunities identified by the AI!

After hardships, no ease! Chinese regulators are considering a serious, unprecedented penalty for DiDi Global after the ride-hailing giant went ahead with its US IPO, last month, despite pushback by the CyberSpace administration of the country. The stock continues to tank, 11% on Thursday.

Lending made easy! A recent Biden order has made lending money easier for Americans, who will now be able to download their Banking Data and provide it to the lenders - making an assessment of earning, spending, and savings easier, unlike the credit score!

The cup might have gone to Rome but Euro-2020 has given UK’s Retail Sales a much-needed push, to 0.5% higher in June compared to May and to the expected 0.4%. FTSE breached 7000 points!

Meanwhile, the Eurozone PMI rose to 60.6 in July, the highest since 2000, indicating the fastest expansion in business activity and bolstering hopes of a rapid economic rebound.

US Markets:

Initial Jobless claims fell to a new pandemic era low of 419,000, way above the consensus estimate of 360,000 while the continuing claims turned out to be 3.24m, way above the estimated 3.1m, dampening the sentiment in US markets and briefly threatening the two day rally, following Monday’s rout.

The investors however held their nerve and markets ended marginally upwards at the end of Thursday.

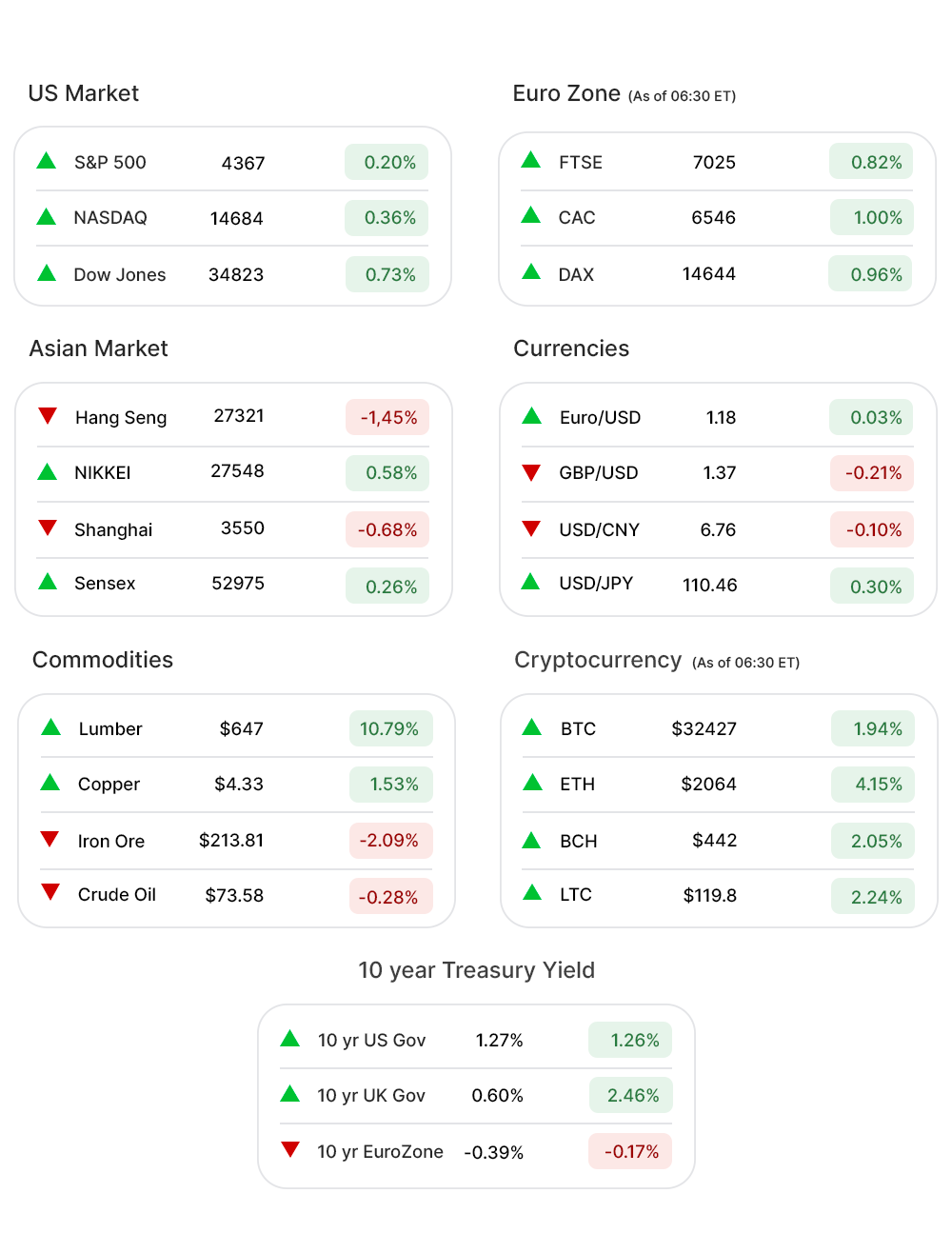

Dow (0.07%▲) could add a miserly 25 points for the day. The S&P 500 (0.20%▲) closed with a gain of just 8 points, while the Tech-heavy Nasdaq (0.36%▲) was a little better off with a gain of more than 50 points.

Sectors in S&P 500 were a mixed bag, with positive ones outnumbering the negative ones by just one. Energy (-1.12%▼) fell again, after gaining a little momentum through the week.

Financials (-0.04%▼), Real Estate (-0.68%▼), Industrials (-0.35%▼) and Consumer Staples (-0.26%▼) were among the losers as well.

Technology (0.71%▲) extended its rally, while other gainers among the sectors were a little over the flat line - Healthcare (0.66%▲), and Communication Services (0.40%▲) included.

Futures!

Futures were rallying, early Friday morning, and looked all set to provide an impetus to the markets. Will it be another winning week after the streak was broken last week?

As of 07:00 ET: Nasdaq Futures (0.50%▲), S&P 500 Futures (0.49%▲), Russell 2000 Futures (0.69%▲), and Dow Futures (0.47%▲) looked solid.

Key Movers in Small Cap:

Seres Therapeutics (MCRB, -61.83%▼) has announced that its phase 2b study of SER-287, targeting ulcerative colitis, did not meet the primary endpoint. The relative volume of the stock was 11.6.

The computer networking company, Netgear Inc. (NTGR, -9.53%▼) missed the consensus on its earnings report with a revenue of $308.8m against expected $314m and an EPS of $0.57 lower than the expected $0.71. The relative volume of the stock was 8.7.

Arvinas Inc (ARVN, 8.97%▲) announced a global collaboration with Pfizer to develop and commercialize its lead drug, ARV-471, used for treating breast cancers. The relative volume of the stock was 7.8.

The Spanish language streaming and broadcasting company Hemisphere Media Group (HMTV, 6.68%▲) is exploring options that include a potential sale of the company. The relative volume of the stock was 7.6.

The other movers in the small-cap segment included:

Finch Therapeutics (FNCH, -17.33%▼): Relative Volume 25.6

Harpoon Therapeutics (HARP, -11.68%▼): Relative Volume 10.6

Evelo Biosciences (EVLO, -22.71%▼): Relative Volume 8.4

Summit Financial Group (SMMF, -2.73%▼): Relative Volume 6.9.

Resources Connection (RGP, 14.24%▲): Relative Volume 6.8.

Key Movers in Large Cap:

Domino’s Pizza (DPZ, 14.55%▲) has beaten estimates in its earnings report*. The relative volume of the stock was 6.0.

FirstEnergy (FE, 4.29%▲) has agreed to pay a $230m penalty to the Justice Department to settle bribery charges pertaining to a nuclear plant bailout. The relative volume of the stock was 3.5.

Shift4 Payments (FOUR, 3.42%▲) has bounced back after announcing it has upsized and priced an offering of $550m aggregate principal amount of 0.50% convertible senior notes (due 2027), increased from previously announced offering size of $500m. The relative volume of the stock was 3.0.

The other movers in the large-cap segment included:

Grocery Outlet (GO, -7.45%▼): Relative Volume 2.0.

OneMain Holdings (OMF, -2.44%▼): Relative Volume 2.9.

NetApp Inc (NTAP, -1.49%▼): Relative Volume 2.8.

Sonoco Products (SON, -4.83%▼): Relative Volume 2.8.

Americold Realty (COLD, -2.39%▼): Relative Volume 2.8.

Report Card:

The social media biggie Twitter Inc (TWTR, 0.04%▲) has reported a 74% increase in revenue y-o-y. At $1.19bn it is also better than the estimated $1.06bn. Advertising revenue of $1.05bn is up 87% y-o-y coupled with an 11% growth in monetizable DAU’s. The stock advanced more than 5% after hours.

The pizza giant gets a bigger earnings slice*. Domino’s Pizza (DPZ, 14.55%▲) has beaten the estimates, reporting a revenue of $1.03bn vs the estimated $972.3m and an adjusted EPS of $3.12 way ahead of the expected $2.87. The stock rose more than 14% after hours.

Abbott Laboratories (ABT, -0.61%▼) has reported an EPS of $1.17, beating the estimates by 15.8%. The revenue has jumped to $10.22bn, up 39.5% y-o-y and beating the estimates by more than 5%. The stock was flat after hours.

The American Airlines (AAL, -1.12%▼) has grown by more than 350% y-o-y to $7.48bn, even as the company has narrowed down on the losses, reporting a loss of $1.69 per adjusted share versus $7.82 a year ago. The stock continued to dip after hours.

After a loss of $1.61 per share, a year ago, Capital One Financial (COF, -1.08%▼) has reported an EPS of $7.71 beating the estimates of $4.78. The revenue of $7.37bn has beaten the estimates by 3.82%. The stock slid more than 1% after hours.

On the Lookout:

Update on the measure of US factory activity, Markit Manufacturing PMI, is due today along with the Markit Services PMI.

Here are some upcoming IPOs:

The cell analysis solutions company, Cytek Biosciences, is offering 16.7m shares of its common stock, priced at $17.

The genome-editing Biosciences company, Caribou Biosciences, has announced to go public and is offering 19m shares of common stock at a public price offering of $16 per share.

The content marketing platform, Outbrain, is offering 8m shares of its common stock, priced between $24 to $26 per share.

A provider of specialized impact financial services, Preston Hollow Community, is offering 10.5m shares of its common stock, priced between $18 and $20 per share.

Traeger Grills or better known as TGPX Holdings Inc, is set to offer 23.5m shares of its common stock, priced between $16 and $18 per share.

Unusually high shorter-term CALL options activity seen on Summit Wireless Technologies (WISA, 13.02%▲), Tencent Music Entertainment (TME, -0.77%▼), Las Vegas Sands Corp (LVS, -4.45%▼), India Globalization Capital (IGC, 89.19%▲) and Coty Inc. (COTY, -3.44%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on D R Horton Inc. (DHI, -2.00%▼), Micron Technology (MU,-2.15%▼), Plby Group Inc. (PLBY, -6.71%▼), Skillz Inc. (SKLZ, -5.37%▼) and Twitter Inc. (TWTR, 0.04%▲).

Other Asset Classes:

Crude Oil extended gains made in the three previous sessions, as demand in the second half of the year is being seen to outstrip the supplies and despite a rise in US inventories last week. Brent Crude was down 0.27% to $73.59 per barrel, early Friday morning.

The US Dollar (92.87, 0.05%▲) made some gains Thursday as well as early Friday morning, after pulling back from a three-and-a-half-month high of 93.194, it touched Wednesday. All eyes will be on the PMI today.

The 10 Year Treasury Yield, fell 2.2 basis points to 1.260% while the 30 Year Treasury Yield slid 3.1 basis points to1.899% Thursday, as Jobless claims data indicated Fed was going to remain dovish on monetary policy for a bit longer. Also, the auction of $16bn in 10-year TIPS was bid at a record low. Friday morning, the yields made some gains.

Global Markets:

The investors in Asian markets showed caution Friday in wake of the rising delta variant cases and a rather flat day in the US markets Thursday. The markets in the Asia Pacific were mostly lower with Hang Seng losing more than 400 points. Shanghai closed in the red as well even as Nikkei showed some promise and rose 159 points.

European Central Bank’s pledge to continue the monetary support and investors upbeat about earnings, outweighed the concerns around rising delta variant cases, in the European Markets. Stoxx-600, was up 0.57% in early morning trade as the major indices also were in green and looking to close the week in gains. Besides,

Meanwhile on Researchfin.ai

There are 30+ new trade setups identified by the AI today. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

See you on Monday! Have a lovely weekend!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.