Who ‘CARES’!

Good Morning!

On Labor Day, around 8.9m Americans will lose all unemployment benefits as two primary anchors of the government's Covid protection package - under the CARES Act - are ending or have already ended. A federal eviction moratorium has already expired.

The year of mergers and acquisitions! The summer growth in global dealmaking, particularly in otherwise dry August, has propelled the mergers and acquisitions to$3.9tr this year so far - more than double the quantity last year and up from 2019’s $2.6tr.

To capitalize on a raging market for private equity, Goldman Sachs planning an IPO for alternative asset managers Petershill Partners - in a deal that could be worth more than $5bn.

The chosen ones! The 66 “select” stocks to be included in Beijing’s new stock exchange - to be launched to help small and medium-sized businesses raise capital - rose more than 30% for a brief period on Monday.

Warren Buffet backed electric car maker, BYD, has reported a 300% increase in August sales, with 61409 new energy vehicles sold in the month - four times more than the number of vehicles sold a year ago. BYD stock rose 5.5% in morning trade at Hong Kong.

Shang-Chi and the Legend of the Ten RIngs! Marvell’s latest release has gobbled up an estimated$71.4m at the domestic box office - second-highest by any movie released during the pandemic and highest by any film released over Labor Day weekend. Global ticket sales stand at an estimated $127m for Friday, Saturday, and Sunday.

The US Non-Farm Payrolls increased, for the month of August, by 235,000 way lower than the expected 720,000 - a significant slowdown from July’s revised 1.053m. The unemployment rate, however, dropped to 5.2% from July’s 5.4%, a new pandemic low. Will this change Fed’s outlook on stimulus tapering?

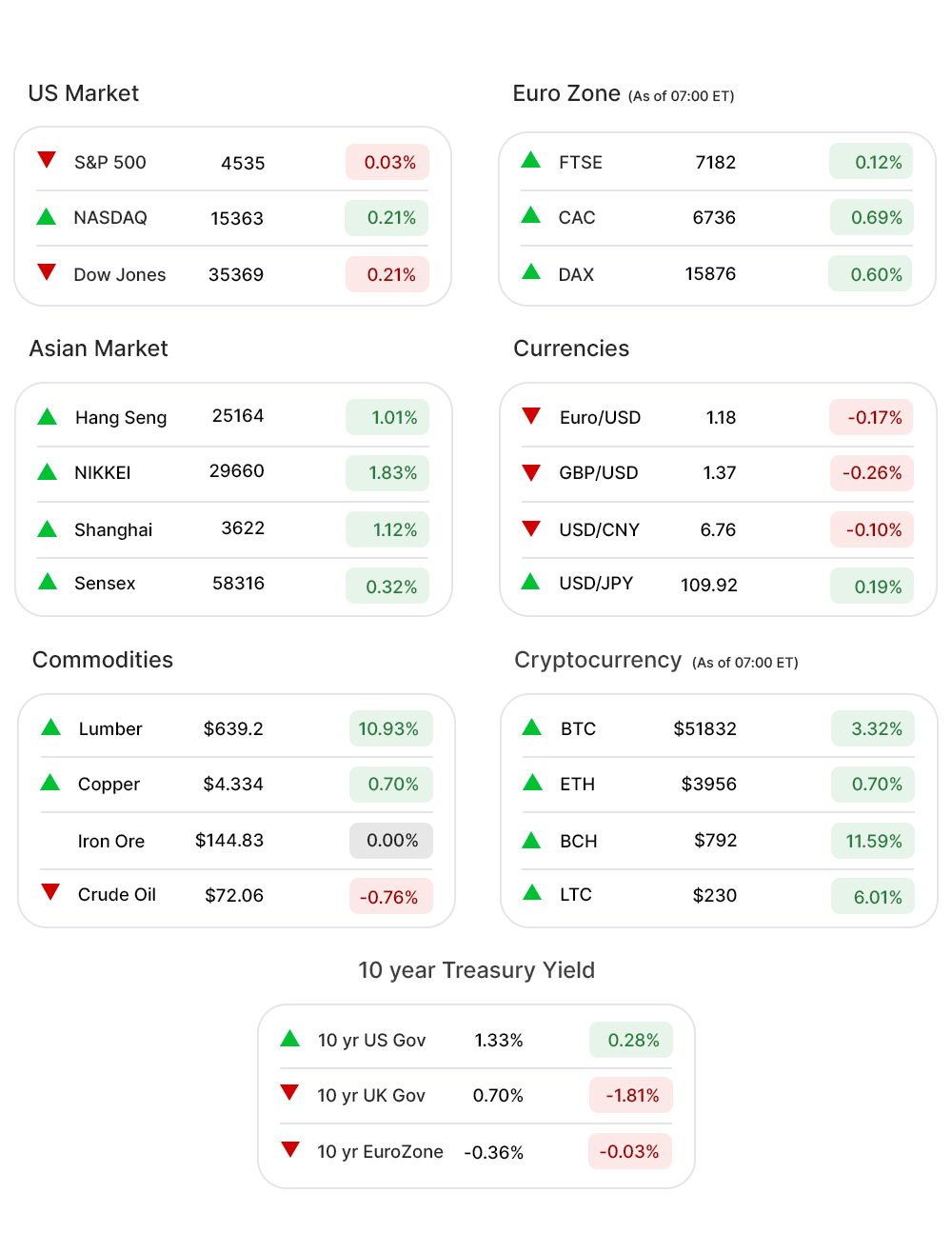

US Markets:

A far weaker Jobs data than anticipated, and a drop in unemployment rate rendered US markets mixed Friday.

S&P 500 (-0.03%▼) dropped a little more than a point to close at 4535.43. Dow Jones (-0.21%▼) shed a little more than 72 points and closed the day at 35369.09, while Russel 2000 (-0.52%▼) lost about 12 points.

Tech heavy Nasdaq (0.21%▲), was the only major index to eke out some gains and closed at 15363.52.

Sectors at the S&P 500 were mixed as well, with five of the eleven sectors in red and the rest in green.

The green sectors included, Consumer Discretionary (0.01%▲), Healthcare (0.11%▲), Technology (0.38%▲), , Materials (0.60%▲), Real Estate (0.04%▲), and Communication Services (0.11%▲).

Financials (-0.58%▼), Energy (-0.52%▼), Industrials (-0.62%▼), Utilities (-0.80%▼), and Consumer Staples (-0.05%▼) were the losing sectors.

Key Movers in Small Cap:

The Impel Neuropharma (IMPL, -19.33%▼) stock plummeted, soon after it soared around 22% Friday morning, following an FDA approval of the company’s first drug, a nasal spray named Trudhesa. The Relative Volume of the stock was 41.5.

Forte Biosciences(FBRX, -82.30%▼) Friday announced that it failed to meet the primary endpoint in a phase-2 study targeting atopic dermatitis. The Relative Volume of the stock was 16.9.

Joann Inc(JOAN, -19.44%▼) continued to tumble after reporting a 30% drop in sales compared to the last year. The Relative Volume of the stock was 11.2.

PagerDuty Inc (PD, 6.95%▲) continued its gaining momentum, after reporting a 33.2% y-o-y increase in revenue. The Relative Volume of the stock was 6.1.

Alexander & Baldwin (ALEX, 8.33%▲) has delivered a respectable 77% return to shareholders in one year, gaining 4.2% in the last week alone. The Relative Volume of the stock was 5.4.

The other movers in the small-cap segment included:

Evelo Biosciences Inc (EVLO, -19.01%▼): Relative Volume 5.3.

Sunstone Hotel Investors (SHO, 1.64%▲): Relative Volume 5.2.

Yext Inc. (YEXT, -6.33%▼): Relative Volume 5.1.

Ooma Inc. (OOMA, 14.65%▲): Relative Volume 5.1.

Metromile Inc. (MILE, 8.33%▲): Relative Volume 4.4.

Key Movers in Large Cap:

MongoDB Inc (MDB, 26.33%▲), the cloud-based database specialist, outperformed expectations on both top and bottom-line results in its Q2 earnings report. The relative volume of the stock was 11.2.

DocuSign Inc (DOCU, 5.26%▲) reported a sizable earnings beat, late Thursday evening. The relative volume of the stock was 5.2.

Guidewire Software Inc (GWRE, 3.86%▲) reported a 29% y-o-y increase in subscription revenue. The total revenue dropped 6% y-o-y but was above the expected levels. The relative volume of the stock was 4.5.

The other movers in the large-cap segment included:

Medallia Inc (MDLA, -0.06%▼): Relative Volume 2.8.

Beyond Meat Inc. (BYND, -3.98%▼): Relative Volume 2.7.

Nutanix Inc. (NTNX, 7.03%▲): Relative Volume 2.5.

Science Applications. (SAIC, 2.05%▲): Relative Volume 2.4.

Credit Acceptance Corp. (CACC, 1.56%▲): Relative Volume 2.3.

Report Card:

DocuSign Inc (DOCU, 5.26%▲), the cloud-based e-signature company, reported an EPS of $0.47 on revenue of $511.8m, comprehensively beating the estimated EPS of $0.40 on revenue of $487.5m. The stock climbed a little more after hours.

MongoDB Inc (MDB, 26.33%▲) reported a 44% y-o-y growth in revenue to $198.7m, ahead of the estimated $184.2m. The adjusted operating loss of $11.5m was a little wider than last year’s $10.2m. The stock skidded a wee bit after hours.

Joann Inc(JOAN, -19.44%▼) reported a net income of $5.2m or 12 cents per share, on revenue of $496.9m, compared to last year’s net income of $149.9m, or $4.29 a share, on revenue of $708m. The stock climbed a little more than half a percent after hours.

PagerDuty Inc (PD, 6.95%▲) reported a 33% y-o-y growth in revenue to $67.5m, its strongest growth rate in 5 quarters and ahead of the estimated $65.6m. The adjusted operating loss, however, widened from $3.2m to $9.9m. The stock climbed more than a percent after hours.

On the Lookout:

In wake of the Labor Day holiday - celebrated on the first Monday of September - the stock markets in the US remain closed. The economic calendar will draw a blank today.

Unusually high shorter-term CALL options activity seen on Rover Group Inc (ROVR, 00.00%▲), Riot Blockchain. (RIOT, -4.25%▼), Moderna Inc. (MRNA, 4.79%▲), Lucid Group Inc (LCID, 4.82%▲), and Advanced Micro Devices (AMD, 0.66%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Tesla Inc (TSLA, 0.16%▲), Fisker Inc (FSR, -0.99%▼), Cassava Sciences Inc (SAVA, -7.64%▼), Philip Morris International (PM, 0.44%▲), and Virgin Galactic Holdings (SPCE, -6.58%▼) among others.

Other Asset Classes:

Crude Oil Prices - The prices went down Monday morning soon after Saudi Arabia, the world’s top exporter, slashed crude oil prices for Asia - indicating that global supplies were well supplied. Brent traded a little over $72 per barrel mark, in the wee hours Monday.

The US Dollar (92.25, 0.24%▲) bounced from last week’s steep sell-off to the sub-92 levels early Monday morning, as the markets remain closed for Labor Day.

The US Treasury Yields remained buoyed after a poor August jobs report. Monday morning the 10 Year US Treasury Yield was trading at 1.326%, into the green zone.

Global Markets:

The Asian Markets ended mostly higher Monday, following dismal August jobs report in the US raising expectations amongst the investors that Fed might revisit its stimulus tapering policy. Shanghai closed 1.12% higher, and Hang Seng rose more than 160 points. Tokyo’s Nikkei advanced in excess of 530 points or 1.83%.

European markets cashed in on the wave in Asian stocks and opened considerably higher Monday morning. The speculation that stimulus might be furthered in China and Japan gave further impetus to the global markets. FTSE, gained 0.68% soon after the opening, while CAC was up 0.70%. DAX and Stoxx-600 gained 0.62% and 0.59%, in that order.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Myovant Sciences Limited (MYOV), HUTCHMED China (HCM), Semtech Corporation (SMTC), Silk Road Medical Inc. (SILK), DigitalOcean Holdings (DOCN), Pure Storage Inc (PSTG), Semrush Holdings Inc (SEMR), Seer Inc (SEER), Cameco Corp. (CCJ), Golden Nugget Online Gaming (GNOG), and Kulicke and Soffa Industries (KLIC). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.